Darien Tax Assessor Anthony Homicki expects a smaller number of taxpayers will want to appeal their tax assessments this year, in part because the assessments didn’t change much, overall, and in part because the town is making more information comparison available to taxpayers.

Those were some of the points Homicki made in a recent presentation to the Board of Selectmen last week about this year’s revaluation. The same day, Homicki’s office mailed out 6,500 letters to property owners with their revaluation information.

- See also: Assessor: Darien Property Tax Assessments Coming in the Mail Within Days (Nov. 14)

Individual assessments will be used when the town calculates future tax bills, based on upcoming tax rates.

You can see a Darien TV79 video of his presentation on Vimeo.com, or at the bottom of this article.

Here is an edited transcript of Homicki’s talk to the selectmen (see the bottom of this article for an explanation of how the transcript was edited):

I guess the bulk of [property revaluation] changes are within 2 to 4 percent. You don’t have a blanket reduction or a blanket increase.

Zoning does come into play. The properties that are in the northern third of town, with two-acre zoning — we saw those, instead of the average days on the market of about 240 to 260 days, some of the larger homes on in the northern section of town have been on the market over 300 days. It comes into play on how much exposure they have and where the regional economy is.

[Darien isn’t unusual in this pattern of home sales.] I’ve talked to my colleagues in New Canaan, Westport, Norwalk, even in Greenwich.

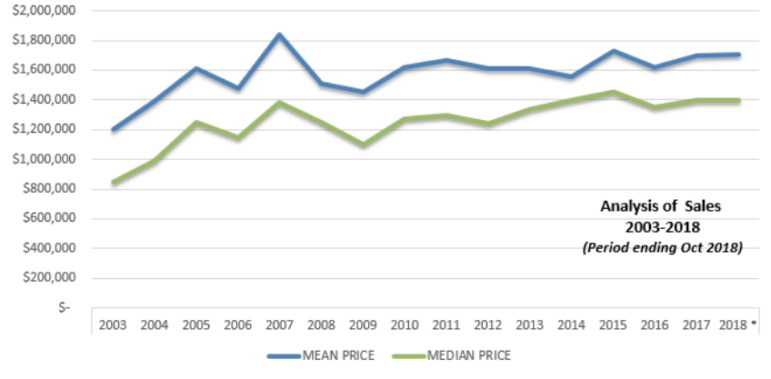

Chart from the Darien Tax Assessor's report

2

Eighty-six percent of our tax base is residential. If you look at that line chart […] You’ll see that the median prices, the mean price, sort of stabilized overall. If you look at the averages just above the $1.6 million price range and [compare] the median vs. the mean, it shows a healthy community, a healthy marketplace.

[Editor’s note: When a set of numbers don’t have significant outliers (numbers much bigger or smaller than the rest), then the mean — that is, the average — is generally thought to be the best way of comparing different sets (such as the sales prices in a given year), according to the Diffen.com website. But if one or a few high or low numbers are much different from the rest — such as the sale of a very expensive property in Darien in a particular year — statisticians often prefer the median (that number in a range of different numbers that has as many larger numbers as smaller ones) to get a sense of how overall change is happening.]

Recent Assessment History and How 2018 Compares

Homicki said this year’s assessment doesn’t have wide swings in lots of individual property revaluations, and the process is transparent enough to taxpayers that he doesn’t expect as many tax-assessment appeals as the town has had before.

I’ve been your assessor for 14, close to 15 years. I’ve followed this cycle [of town property tax revaluations] a couple of times already.

In 1999, when I wasn’t here, you automated it. […]

In 2003 there was an update, refreshed with a variety of different software systems.

Transparency today

[The year] 2008 was quite the challenge, with the economy changing as quickly as it did. And, in essence, that was a base year of change. We had close to 700 to 800 hearings at that time because we weren’t transparent — we weren’t open for everyone to look at the records and, really, to find and identify what their real estate [estimated value] was all about.

If you go into the town website today, you’ll see that quite a bit in the Assessor’s [Office] section has been updated […] We have a question-and-answer about the revaluation and property tax and a press release […] that really focuses on the overview of where revals are at. […]

Big swings in previous years, but not this one

In 2003 we had significant changes in waterfront properties, where some of those went up 20 percent.

In 2008 we had a significant change in the economy — the recession hit hard and it hit fast. In 2008 we actually lowered values by anywhere from 4 to 6 percent, townwide.

And 2013 was a difficult revaluation because that market had really never recovered from the 2008 recession. […]

I guess the bulk of changes [this year] are within 2 to 4 percent. You don’t have a blanket reduction or a blanket increase.

Plenty of Sales Means Lots of Comparison Data

Positives of this revaluation [are] that entry-level [new or rebuilt] housing, 500 or 600 building permits that we have: I find [in] entry-level housing that a lot of these [building] permits [for houses that] have been worked on and become approved [by town officials are in] a price range between $700,000 and $1.6 [million or] 1.8 million.

It’s the bulk of our community: It’s homes and residences within this [price] neighborhood. We’re finding that these values are within a 2 and 3 percent, up or down. […]

It’s been an active market. We’ve had a lot of sales — over 640 sales that we’ve looked at over three years. […]

Picture from Darien TV79 video

Town Tax Assessor Anthony Homicki speaking to the Board of Selectmen

Again, if we had 6,500 parcels and I only had 100 sales, I would be here this evening saying it’s more than a challenge. When you have 600 to 700 sales, there’s a lot of statistics to hit right out of the park.

We have something called “outliers,” where properties might have unique situations that we don’t have in the database. I don’t believe there’s more than 10 or 12 of those, which is a pretty good market range. […]

[Over the past five years, Homicki said, the Assessor’s Office has been analyzing real estate sales, getting close to 1,100 sales, although the database includes only homes sold in the last 24 to 36 months.

[Compared with the sales numbers used in the 2013 revaluation, Homicki said, the recent sales numbers are comparable, “within 10 or 20 sales.”]

What You Can Find on the Town Website

That list of sales [is] on the website […]

[The property listing] will have a list number on it, the address of the property, a map [number] and lot number, the neighborhood number, acreage, zoning, the style of the property, the date of the sale and the sale price. All 600 to 700 properties are in that database.

I think with the Q-and-A and the report I’ve given you, it’s a good overview of where revaluations are.

Work Involved in the Revaluation

The Tyler [Technology] company is a nationally recognized company that we’ve used in the past. It’s a three-person crew that has been on task for almost nine months. They’ve done a great job, where we’ve, in fact, visited all properties in town twice — the exterior reviews. There’s no state mandate for interior inspection, but we have followed up with averaging, like I said, 400 to 600 building permits a year.

We’ve taken photographs of each and every property twice over the past two winters. When my assistant and I visit properties on all the building permits that are given to us, we take updated photographs of those properties, also.

The project started, under contract, in January of ’18. We’ve analyzed income and expense statements [of the Tyler company project in Darien], as mandated by state law.

Commercial taxpayers give us very thorough, very complete [reports] We have about 95 percent compliance, I think, overall, for the upcoming expense statements.

[For] the commercial data collection: all properties have been reviewed and inspected to detail. Valuation of the land analysis and building is something required by state statute.

We have final reviews that have taken place, with myself and two supervisors who are working on this job […]

We have to meet statistical standards in order to sign off on this project.

Hearings: Formal and Informal

Informal hearings [with Tyler, the consulting company] will be available, if needed, by any and all citizens of the Town of Darien. […]

They’ll be scheduling these hearings downstairs in the conference rooms [in Town Hall] and we’ll have that [phone] number available through Nov. 29.

[For] hearings, we anticipate maybe a couple hundred, but again if people would go on the town website, look at all the detail within the Assessor’s [Office] section, I’d be very grateful. I think it would satisfy any anxiety or any concerns. […]

The meetings that taxpayers concerned about their revaluation can set up a meeting to speak in an informal review with the Tyler Company representatives is Nov. 29, Homicki said.

Independent of that, taxpayers can formally appeal a tax revaluation with the town Board of Assessment Appeals, he said. The deadline for that application is Feb. 20, 2019.

How to Contact the Appraisers

Here’s an excerpt from the end of the news release on contacting officials if you still have questions about the process or how your individual assessment was calculated:

- Informal appeal hearings are available by calling the Tyler Technology appraisers.

- Formal appeals of the change in assessment can be made by filing an appeal application with the Assessor’s Office on or before Wednesday Feb. 20, 2019.

- Again, first check on the variety of data on the Assessors area on the Town Website. If you have questions in regard to the value and would like to meet with an appraiser please call: Tyler Technology at 1-877-895-9675 before Thursday Nov. 29, 2018.

- General questions and concerns are to be directed to the Assessor’s Office at 203- 656-7310 Monday through Friday between 9 a.m. and 4 p.m.

_______________

Editor’s note: How this transcript was edited: The transcript published here quotes his words but with some paragraphs rearranged. Elipses — “…” marks — indicate words were removed. Words in brackets were added for clarity — sometimes to rephrase, sometimes to add information. Subheadings have been added.

You can watch Homicki’s talk here (from about the 0:45 to 11:30 time stamps on the video):

Board of Selectmen 11-13-18 from Darien TV79 on Vimeo.