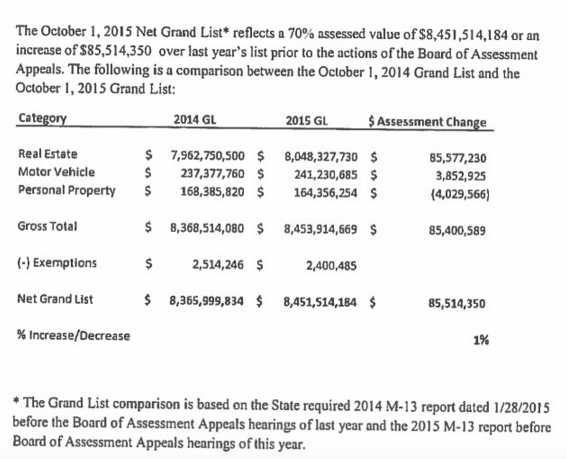

Residential property increased slightly in value but property assessments were down for town businesses in 2015, according to figures in Darien’s Grand List of tax-assessed properties, which rose a total of 1 percent in the year leading up to Oct. 1, 2015.

Commercial real estate was assessed at a quarter of 1 percent below the previous year’s value, and personal property — essentially non-real estate business property that can be taxed — fell by 2.4 percent from Oct. 1 2014 to the same date in 2015.

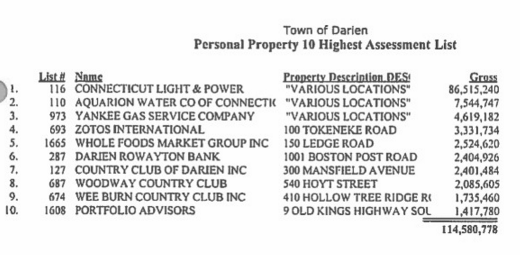

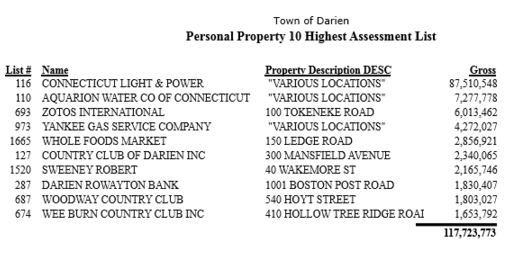

Zotos International, a beauty products company with offices at 100 Tokeneke Road, was assessed for personal property taxes in 2015 close to half of what it had been assessed in the previous year — $3,331,734, down $2,681,728 from the previous year, a drop of 45 percent (it had been assessed at $6,013,462).

Tax assessments for Eversource’s equipment in town went up by just over $1 million.

(The Grand List is officially set for the upcoming year’s taxes each year on Oct. 1. All comparisons are for assessments before property owners appeal the amounts. Assessment numbers reflect 70 percent of total assessed value — the amount used for tax purposes.)

Town Assessor Anthony Homicki reported the figures from the Grand List to Finance Director Jennifer Charneski in this memo dated Jan. 28, attached to the report Homicki sends each year to the state.

The new total is $8.4 billion, according to the Town Assessor’s Office. The rise was also 1 percent in the previous 12-month period, according to figures released by the office.

___________

Other articles from Darienite.com about this year’s Grand List:

- These are the 10 Most Expensive Cars Owned in Darien (Feb. 6)

- These are Darien’s 10 Most Expensive Pieces of Real Estate (Feb. 7)

___________

The town office files an annual report with the state in late January of each year. According to this year’s and last year’s reports (which give information on the Grand List as of Oct. 1 for each year).

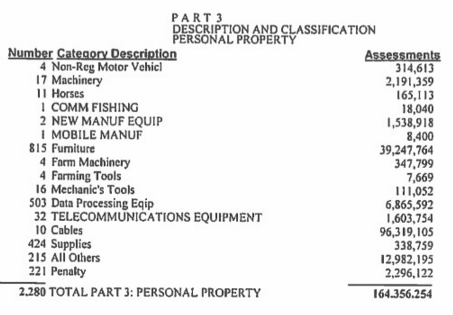

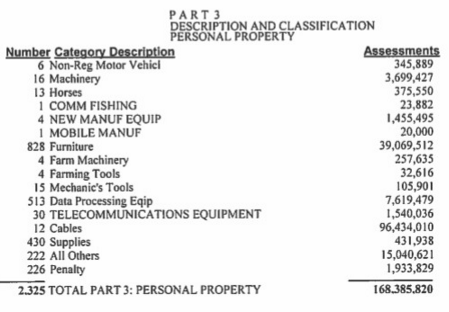

Assessments on personal property fell from $168,385,820 in 2014 to $164,356,254 in 2015, a total of $4,029,566 or 2.4 percent. From 2013 to 2014, that category had increased by $1.7 million.

Some details on personal property tax assessments for 2015.

Here’s the same table listing types of personal property taxes for the 2014 Grand List:

Darien personal property taxes, broken down by type, for the Oct. 1, 2014 Grand List

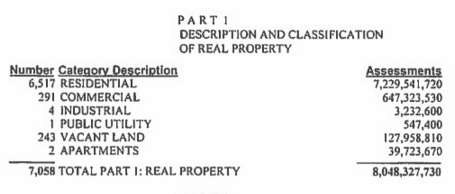

Total real estate assessments rose from $7,962,750,500 to $8,048,327,730, an increase of $85,577,230 (the increase for 2013 to 2014 was $75,810,130).

Oct. 1, 2015 Grand List figures

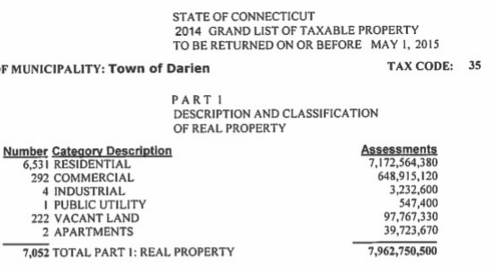

The same Grand List figures from Oct. 1, 2014 in the town\’s previous annual report to the state.

For 2015, residential real estate assessments, the lion’s share of the tax base in town, were up a total of $56,977,340 or 0.8 percent to $7,229,541,720 on 6,517 homes in town (up from $7,172,564,380 on 6,531 homes in 2014 — the town tax rolls lost 14 homes).

In commercial real estate assessments, there were 291 properties with a total tax assessment of $647,323,530 in 2015, compared with 292 properties in 2014 assessed at $648,915,120. That’s a drop of $1,591,590, or a quarter of a percent.

Twenty-one more parcels were counted as “vacant land” on the most recent tax rolls — 243 parcels this year with a total assessment of $127,958,810, up from 222 parcels assessed at $97,767,330 in 2014 (the total assessments in this category rose by $30,191,480 — or 9.5 percent more parcels worth 31 percent more than in 2014).

The top 10 personal property taxpayers in Darien for 2015 were three utilities (for electricity, water and gas), three country clubs (Darien, Wee Burn and Woodway) rounded out by Zotos International, Whole Foods Market, Darien Rowayton Bank and Portfolio Advisors.

Here’s the list and the assessment for each:

The top 10 Darien personal property taxpayers as assessed on Oct. 1, 2015

That compares with this list for 2014:

Top 10 assessments for personal property taxes in 2014 in Darien

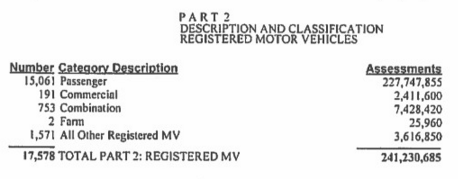

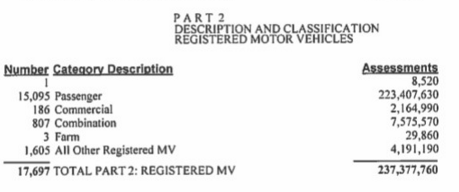

Motor Vehicle tax assessments were up in 2015, to a total of $241,230,685 on a total of 17,578 vehicles. That’s up slightly from $237,377,760 the year before.

Details from the report on motor vehicle assessments for 2015.

Motor vehicles assessed in 2014

The number of vehicles went down by 119 from the year before, with most of the drop coming from various kinds of business-owned vehicles (the number of personally owned vehicles not used for business was down by 34).

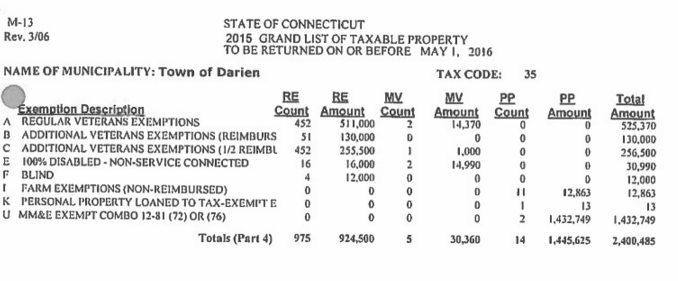

These types of tax exemptions have been given by the town for the 2015 Grand List (they’ll take effect for 2016 taxes):

Tax exemptions by type and amount in the 2015 Grand List

Pingback: Taking Care of Business in Darien: News Notes from Around Town | Darienite

Pingback: These are Darien’s 10 Most Expensive Pieces of Real Estate | Darienite

Pingback: Selectmen Propose Budget with 4.49% Lower Spending Than This Year | Darienite