If you accept a check from someone you don’t know, don’t use part of the proceeds to send money back to the stranger. No matter what the circumstances.

That’s the advice police and the Federal Trade Commission give to everyone, because scamming victims this way with false checks is a longstanding problem — one that victimized a 67-year-old Darien man who runs a photography business from his home.

Here’s the police account of what happened:

Someone who appeared to be a potential client of the business contacted the Darien man and offered to hire him for a job. The stranger, who called himself “Daniel Mitri,” said he would send the man a check for $4,100 for a photo shoot.

The stranger asked that the business owner cash the check, then deposit the cash in another account set up by Mitri to pay for other individuals working in the photo shoot. The Darien man did all that and also bought Apple gift cards for additional services for Mitri.

True to the pattern for this scam, after several days, it became impossible to contact Mitri. Then the Darien man was notified by his bank that the check was fraudulent. The business owner lost a total of $4,600.

On April 13, the man contacted Darien police.

All you need to remember to avoid this scam

- Banks are required to make money from deposited checks available to you within days, but weeks later the deposited check may bounce, and you’ll be the one on the hook for the money.

- So if you don’t know for sure that the check is good, don’t spend that money because it really isn’t yours until weeks later.

See more below.

Same Scam, Different Days:

- Police: Local Business Scammed Out of $90,895 With a Bounced Check and a Lie (March 6)

- Norwalk Community College Student, 18, Loses $700 in Classic Check Scam (Dec. 1, 2017) — From that article:

- Darien Police: Don’t Fall for Overpayment Scam in Online Car Selling (April 29, 2016)

- Darien Woman, 25, Taken in Internet Scam with Added Twist (Nov. 19, 2016)

- Police: Darien Teen Gets Close to Being Scammed in Summer Job Scheme (May 16)

Darienite has published the following sidebar more than once before:

More About Check Deposit Scams

Photo by Michael Kooiman on Flickr (via Wikimedia Commons)

A check (for quite a bit less than a typical fraud)

Under federal law, according to the Federal Trade Commission, banks are required to make money available from deposited checks within days — but it may take as long as weeks for a bank to discover that a deposited check is fraudulent.

The bank isn’t liable for what the law requires it to do. You — the person who deposited the check — are liable. If you become a victim, the con artist knew about this, but you didn’t: It’s your responsibility to know if the check you deposited is genuine before using the money.

The Federal Trade Commission’s blog about scams regularly features posts about this kind of scam. One post discusses how this kind of scam occurred with con artists using a website for babysitters and nannies.

One post has this description of the “fake check scam” and simple advice to keep you from getting victimized:

Fake checks drive many types of scams – like those involving phony prize wins, fake jobs, mystery shoppers, online classified ad sales, and others. In a fake check scam, someone asks you to deposit a check – sometimes for several thousand dollars – and, when the funds seem to be available, wire the money to a third party.

The scammers always have a good story to explain the overpayment – they’re stuck out of the country, they need you to cover taxes or fees, you’ll need to buy supplies, or something else. But when the bank discovers you’ve deposited a bad check, the scammer already has the money, and you’re stuck paying the money back to the bank.

So don’t deposit a check and wire money or send money back in any way.

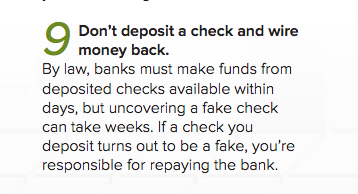

In a brochure published by the FTC, “10 Things You Can Do to Avoid Fraud,” here’s No. 9:

Image from the FTC brochure

From “10 Things You Can Do to Avoid Fraud”

If you are victimized, you can report the matter to Darien police. Also, the FTC suggests:

If you or someone you know was tricked into transferring money – for any reason, report it to the money transfer company:

- MoneyGram: 1-800-666-3947 (1-800-955-7777 for Spanish) or at moneygram.com

- Western Union: 1-800-448-1492

Then, report it to the FTC.