Whether you measure it by tax rate, property taxes paid or even by property taxes on motor vehicles, Connecticut ranks No. 4 for property taxes among the 50 states and the District of Columbia, according to a financial service website.

WalletHub, a website that offers readers information on credit scores and credit reports, ranked only New Jersey, Illinois and New Hampshire (in that order) above Connecticut as having larger typical property tax rates.

The report comes at a time when the state’s fiscal woes have led Gov. Dannel Malloy to propose measures that would lead to higher property taxes in the state.

(You can see the WalletHub report and all of its interactive charts here. The charts below are partial and not interactive.)

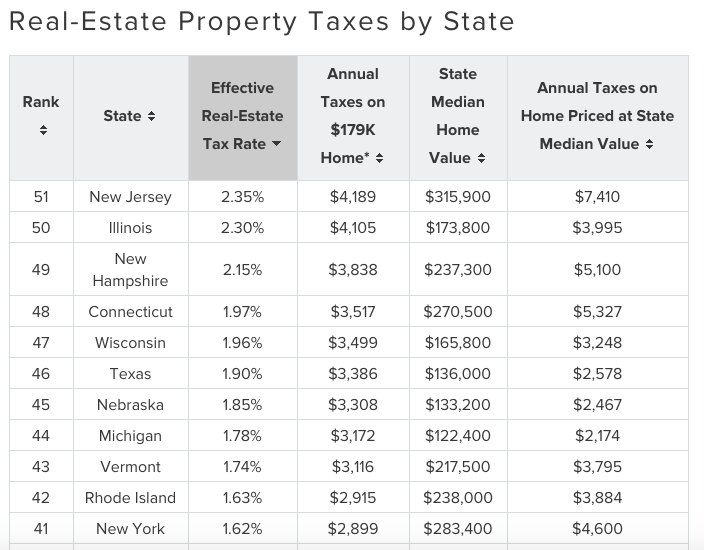

This image of the top end of the table is from the WalletHub website

WalletHub’s ranking by property tax rates, with No. 51 the highest. Connecticut comes in at No. 48.

Hawaii has an effective real estate tax rate of 0.27 percent, according to WalletHub (compared with Connecticut’s 1.97 percent rate). States also get revenues from sales taxes, income taxes and various business taxes, so a state low in one type of tax may be high in other taxes.

Ranked by total amount of property taxes paid by a state’s median home value, Connecticut ranks second in the nation, behind only New Jersey. Here’s what the same table looks like when adjusted for that, with the highest at the top:

States listed in order by highest taxes paid on the median home value for that state, with the highest first. Connecticut ranks second.

The lowest property tax bills are in Alabama, where only $543 is paid for a median priced home valued at $125,500.

Connecticut’s No. 2 ranking for highest taxes paid isn’t just due to it having higher home values. The Nutmeg State is outranked in that regard by Hawaii, the District of Columbia, California, Massachusetts, New Jersey, Maryland and New York, in that order. Only New Jersey presents homeowners assessed at the median for the state with a higher tax bill.

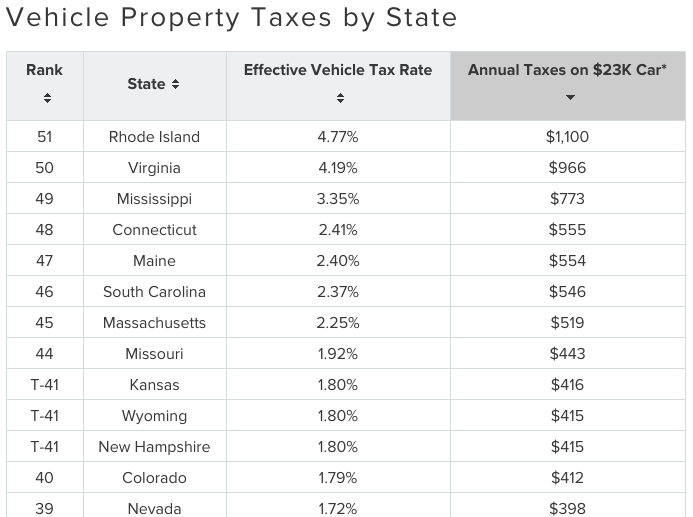

Connecticut doesn’t have the highest property tax rates for motor vehicles, but it still ranks high in actual taxes paid for a car assessed at $23,000: The state is No. 4 in that ranking, with an average annual bill of $555. Only Rhode Island, Virginia and Mississippi have higher tax bills. Dozens of states don’t tax cars.

Motor vehicle taxes by state, starting with the highest taxes on a car valued at $23,000.

WalletHub said it got its rankings this way:

Methodology

In order to determine the states with the highest and lowest property taxes, WalletHub’s analysts compared the 50 states and the District of Columbia using U.S. Census Bureau data to determine real-estate property tax rates and by applying assumptions based on national auto-sales data to determine vehicle property tax rates.

For real-estate property tax rates, we divided the “median real-estate tax payment” by the “median home price” in each state. We then used the resulting rates to obtain the dollar amount paid as real-estate tax on a house worth $178,600, the median value for a home in the U.S. as of 2015, according to the Census Bureau.

For vehicle property tax rates, we examined data for cities and counties constituting at least 50 percent of a given state’s population and extrapolated this to the state level using weighted averages based on population size. For each state, we assumed all residents own the same vehicle: a Toyota Camry LE four-door sedan — 2016’s highest-selling car — valued at $23,070, as of February 2017.

Please note that Georgia formerly imposed vehicle property tax but replaced it in 2013 with a one-time tax imposed on a vehicle’s fair market value (FMV).

Sources: Data used to create this ranking were collected from the U.S. Census Bureau and each state’s Department of Motor Vehicles.

Property Tax demon, from a British cartoon sometime before 1814 (from Wikimedia Commons)

Labeled “Property Tax” this pre-1814 British cartoon imagines the process as demonic possession ‚ of the taxpayers’ money. “Ha! Ha! Master Bull, I knew I would hit upon something at last to get to the depth of your property. This is Billy Pitt’s [British Prime Minister William Pitt’s] magnet, and it will extract every shilling! So no grumbling, Johnny!”