Without notes, but with a set of 30 slides, Board of Finance Chairman Jon Zagrodzky told the Representative Town Meeting how he and his board are looking at the town’s financial prospects and what factors matter most in how budgets and taxes will be decided on in the next several years.

State decisions on whether to impose teacher pensions would have a huge impact on town taxes, Zagrodzky said, as would any significant rises in health insurance costs — and he provided specific numbers showing how a roughly typical homeowner’s taxes would rise.

Barring some huge events like those — which town officials have no direct control over, he said he and the Board of Finance thought the town likely should have no more than a 3 percent increase in spending this year.

Jon Zagrodzky delivering the Board of Finance 2018 State of the Town address.

Seth Morton, the moderator of the Representative Town Meeting called Zagrodzky’s speech “probably the finest presentation I’ve ever seen here. […] I don’t editorialize during this, normally, but I think that deserves some mention.”

Here’s a transcript of Zagrodzky’s speech, with the slides he was describing (at the bottom of this article you can see the Darien TV79 video which includes his speech):

I’m going to try a few slides and just talk to you conversationally about what I see […]

What I’m going to try to do tonight is stay focused on numbers and talk to you about numbers from a different set of perspectives so you can have an understanding of where we’ve been as a town, where we are today and some scenarios as to what might happen in the future.

So, my agenda today is: I’m going to talk about yesterday, I’m going to talk about today and I’m going to talk about tomorrow, with a bit at the end towards guidance, and one additional thought that I wanted to pass on.

So let’s start with what went on yesterday and what our recent financial trends have been.

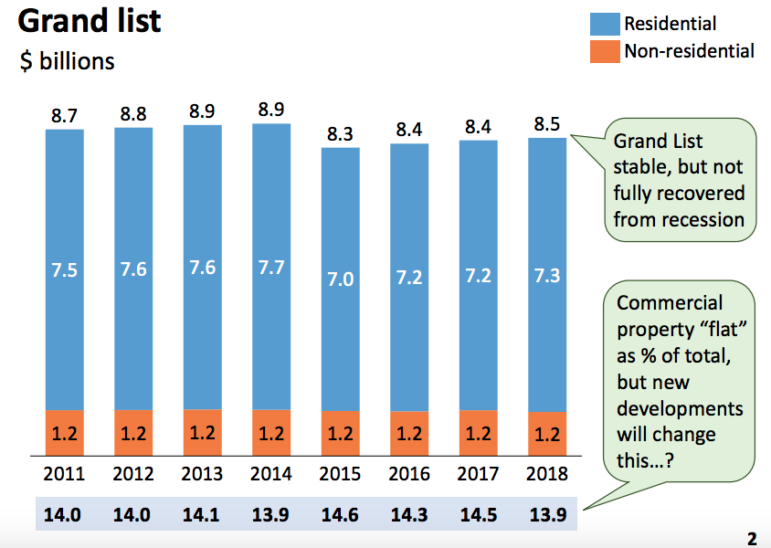

So I’ll start with just a quick overview of the grand list. […] the distinction that I wanted to make was the divide between residential and non-residential. So you can see, as John [Sini, chairman of the Planning and Zoning Commission] mentioned, our grand list today, 2018, is sitting at about $8.5 billion. […]

You can see that over this time period it’s been relatively stable. The drop from 2014 to 2015 […] was a revaluation as of 2013 and that reflected the hit on property values that we experienced as part of the 2008/2009/2010 recession I guess. But we’ve never really fully recovered from that all these years later.

A further interesting point is just the nature of this split. One of the things that surprised me about this data was the […] commercial property as a percent of the entire grand list actually is fairly stable over this period of time. I would have expected to see it creeping up a bit more, but right now it’s right at 13.9, 14 percent as of the latest grand list. We’ll see what comes out in the [most recent] revaluation. […]

I agree with John [Sini] that these new projects are going to start to change that mix, but keep in mind, that 13.9 percent represents $1.2 billion in non-residential property in town, so these projects certainly are going to add to that in terms of valuation, but not in a way that dramatically changes these numbers.

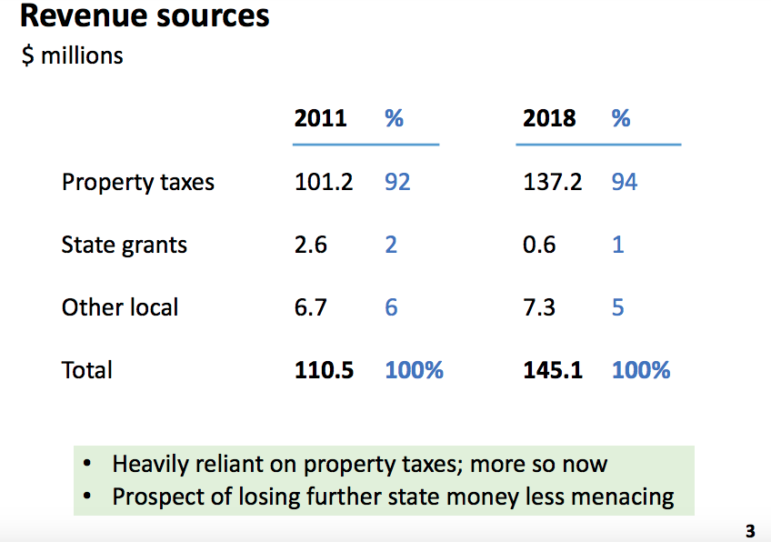

Taking a look at revenue sources for the town, what this shows is that back in 2011 we had a little over $100 million in property taxes on a total revenue of about $110 million. That was about 92 percent of our revenue being driven by property taxes. It hasn’t much changed […] by 2018. […]

One thing that I point up here is this 0.6 [in state grants in 2018]. That’s $600,000 in state grants. That’s down from $2.6 million in 2011. This does not include special education cost reimbursement but what you see is, over time, the value of state grants has eroded.

That’s the bad news. The good news is that if they take them all away tomorrow, it’s not as impactful as it would have been otherwise.

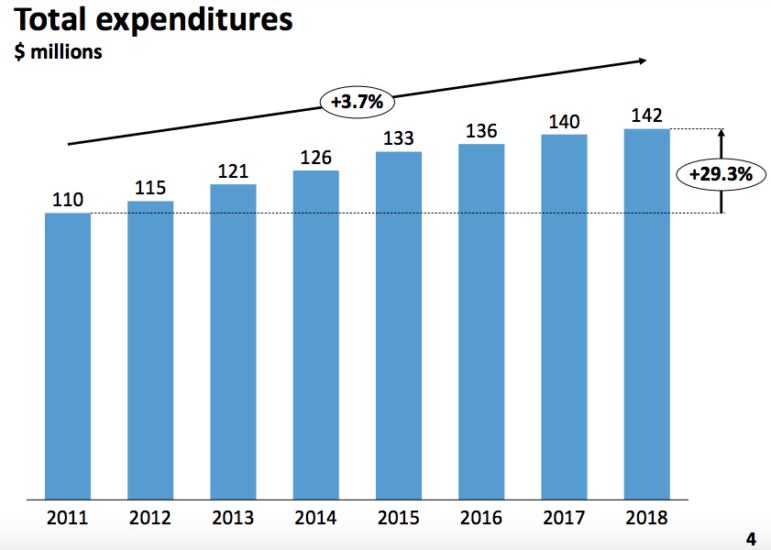

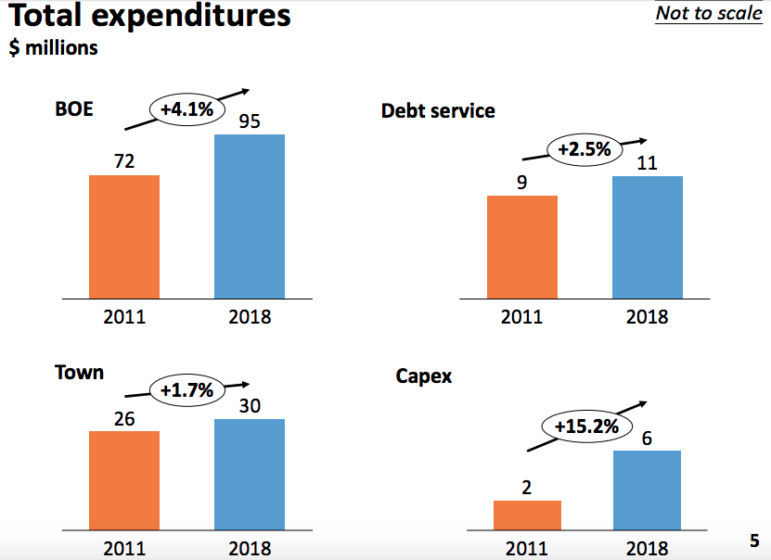

So this is a chart showing simply expenditure growth. These expenditures include the town [side of local government spending, as opposed to education], debt service expenditures, Board of Education, everything. […]

That’s a compound annual growth rate of 3.7 percent, and total spending is about 29 percent higher than it was seven years ago. That breaks down into a few categories, so let’s take a look at each one, individually.

What I have here on the left side […] are the most important ones. You’ve got Board of Education growing at 4.1 percent over that same period. The town [non-education spending] growing at just 1.7 percent […] over the same period.

Debt service is a little bit higher but that’s really by design because at the Board of Finance we’ve taken an aggressive tack to try to pay down principal, so you see that in these numbers. And capital expenditures [“Capex” on the slide] are small numbers there. That just happens to be capital spending that we didn’t bond for […]

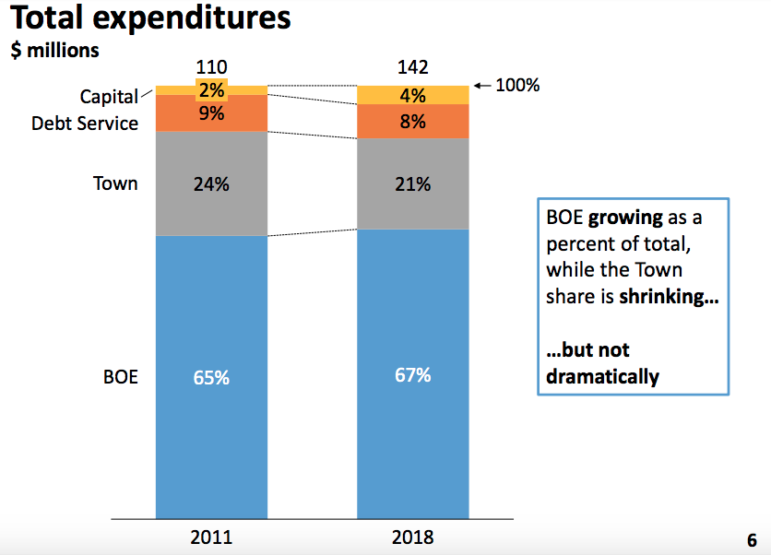

So taking a look at total expenditures a little bit differently: This is a 100 percent chart and it just shows you what percentage of total spending is accounted for in each particular area.

So you can see that the town has fallen off a bit from 24 to 21 percent of total spending. Board of Education is modestly higher from 65 to 67 percent, so they’re growing, but not dramatically. The basic message from this chart is that over time it’s a relatively stable mix.

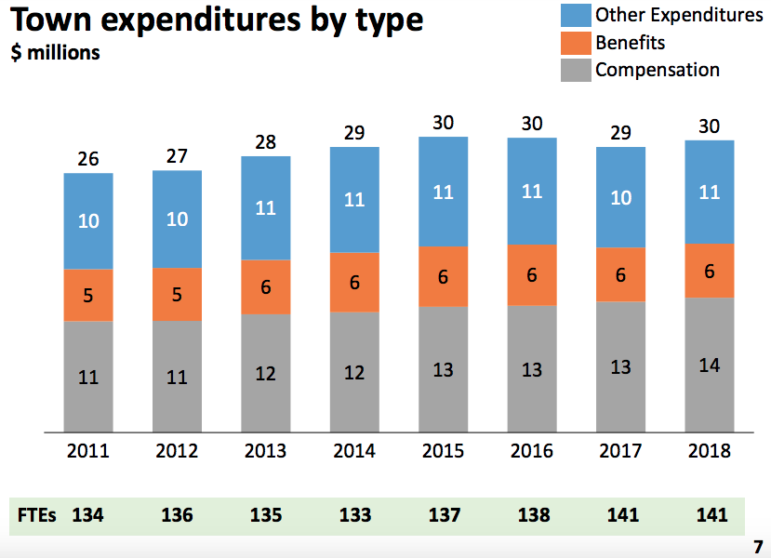

Taking a look at the town a little bit more closely, what this shows is expenditures by type, and so the first type that I’ve got up is just so you could see the difference between compensation and benefits and kind of all the other town expenditures.

What you see is over this period of time a modest expansion in the cost of benefits and obviously with the pay raises and all of that a modest expansion in compensation costs.

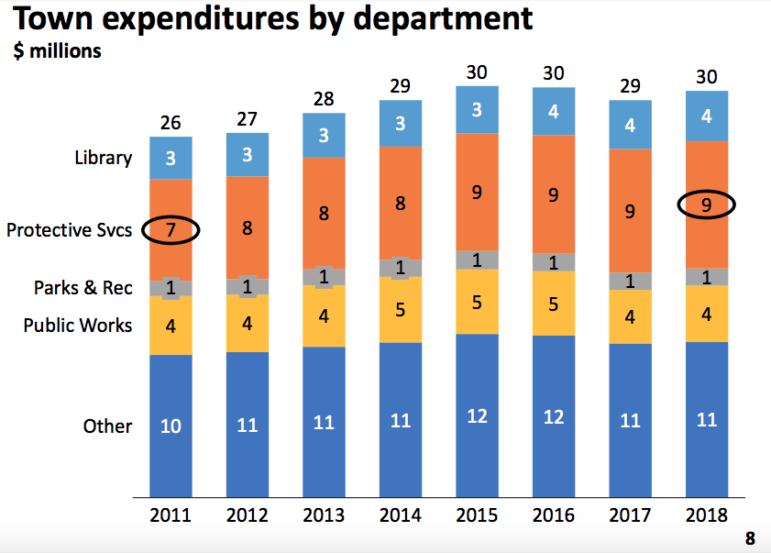

You can look at town expenditures a little bit differently by department, and so what you see here is, again, the same totals at the top but it just shows you some of the major departments and how those totals have changed over time. […]

I point out protective services because we’ve got a lot of personnel in there. Those are, obviously, union-driven contracts […]

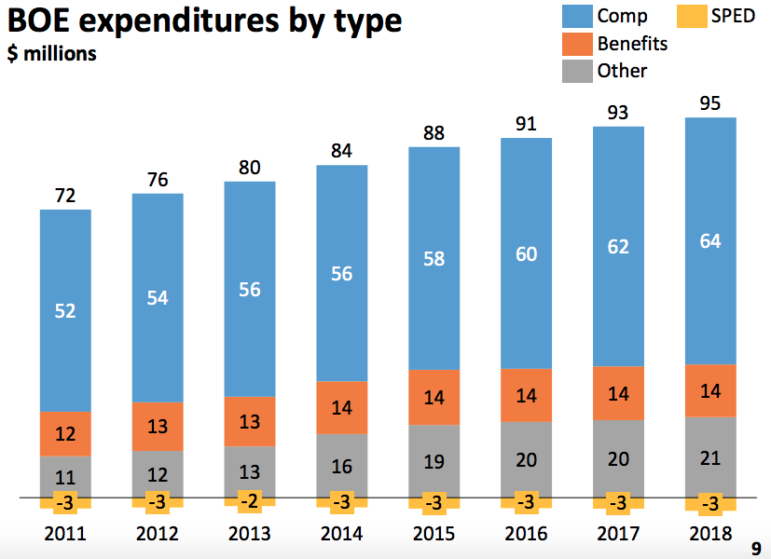

Turning now to the Board of Education, these are the same categories that I had earlier [in Chart 7, above, showing personnel costs]. You can see the difference between compensation, benefits, an other column, down at the bottom, and then I’ve also got the negative numbers there that show you what the special education cost reimbursements [from the state] have been over that period of time.

Obviously, compensation has grown over time fairly substantially, they’ve added staff, and of course there’s the contractual obligations built into those costs as well.

But those expenses have grown more quickly than the town expenses, and so I thought it was worthwhile to spend a few minutes looking more closely at that.

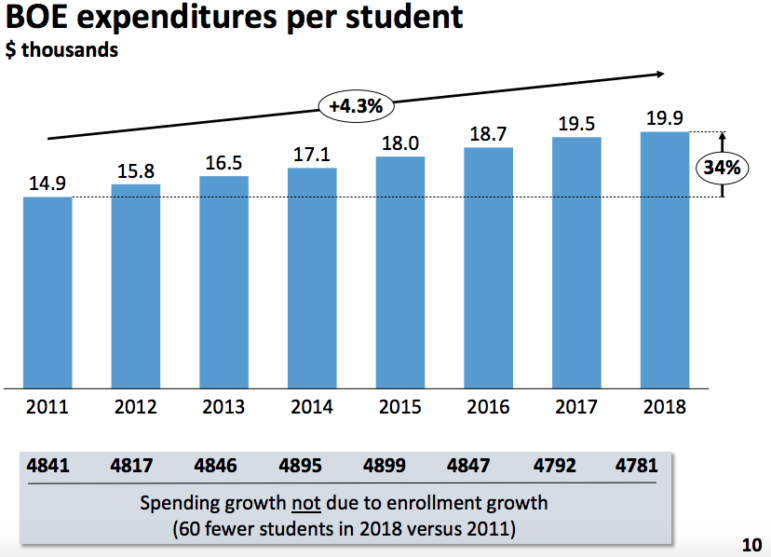

It’s important to note that the Board of Education total expenditures grew by about 4.1 percent on that slide that I showed earlier.

You see, however, that on a per-student basis they’ve actually grown slightly more, and the reason for that is that the number of students for 2018 is actually slightly fewer than it was back in 2011 — very, very flat numbers in terms of students […] The spending growth that you’re seeing, to be clear, is not because we have more students. Spending growth is for other reasons.

The thing I wanted to point out though is that most of that, if not all of it, really is special education.

[Board of Education Chairperson] Tara [Ochman] has brought up the point that it’s important to us to provide for the needs of those students, and I applaud that. At the same time we also need to be open about just how much that costs.

So let’s take a look at a few of these numbers.

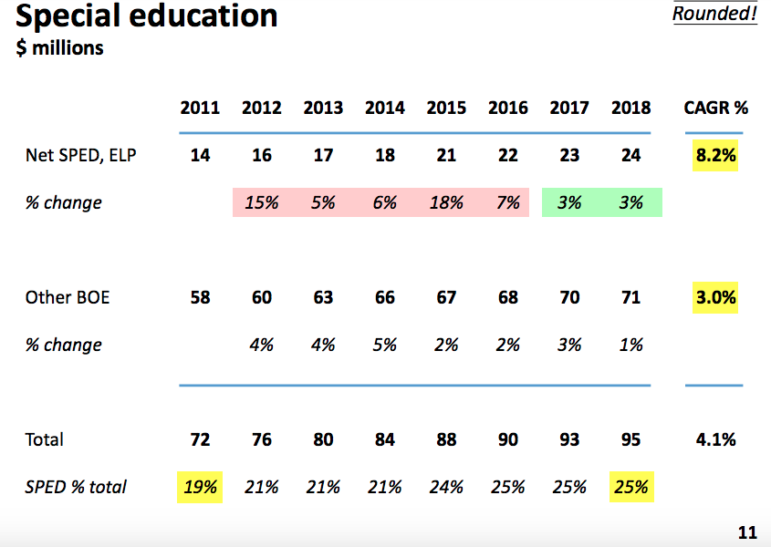

I’ve rounded to keep these charts simple, but you can see up at the top, what I’ve tried to do with this chart is to break out what I call “net special education” — so this is all special education, ELP [Early Learning Program] net of the special education reimbursement by the state, that’s that top line, and then I just did math and said “all other Board of Education” [spending].

Photo courtesy of Jim Cameron

Zagrodzky making a point during his State of the Town address.

So what you see is, first of all is the difference in growth rates between net special education spending and all other spending by the Board of Education. If you just look at “all other” it’s about 3 percent.

So if you think about inflation and union contracts, that feels like a number that you’d like to see over a long period of time, especially given the number of challenges that Tara [Ochman] articulated around investments we have to make in things like security and all of that. Those are all important things.

But if you look at the net special education, that compound annual growth rate [CAGR in the chart above] over that same period of time is north of 8 percent.

You’ll see, though, if you look a little more closely, that most of that growth was in the period of time when we had all the difficult special education discussions and debates — 2012, ’13, ’14, ’15. And you can see there were several years though when the spike in special education expenditures was not trivial.

[Editor’s note: At that time, after many parents of special education students complained, it was found by the state Department of Education that Darien Public Schools were not following state special education law. The superintendent at the time, special education administrators and others quit their jobs or were replaced. The town had to spend more on special education to provide services the state found had been insufficient.]

The good news is that in the last two years, at least, the net special education figure looks a lot better than it has historically, so that’s a good piece of news here in terms of trends.

But the result of all that is that special education — again, net special education — in 2011 was 19 percent of the Board of Education’s budget; today it’s 25 percent.

And with that growth rate of 3 percent [in recent special education spending] starting to equal the growth rate in the rest of the Board of Education budget, if that’s maintained, then this 25 percent figure will stay static.

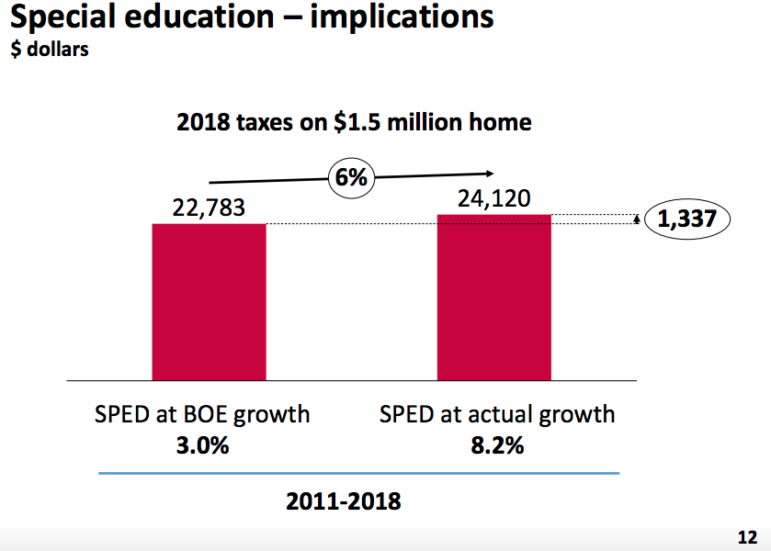

This chart requires a bit of explanation, but I wanted to drive home how much the increase in special education costs impacted the taxes, say, on an ordinary home — well, maybe not too ordinary. But what you’re looking at is the 2018 taxes on a home with an assessed value of $1.5 million.

The actual taxes on that home in 2018 were $24,120. What this chart […] tries to show you, hypothetically is that instead of special education growing at 8.2 percent, like it did over that period, what if it grew at 3 percent, like the rest of the Board of Education budget?

If it had grown at 3 percent, instead of at 8.2 percent, the taxes in 2018 on that same house would have been $22,783. In other words, the taxes on this house are 6 percent higher this year than they would’ve been, because of the increases in special education spending — a difference of $1,337.

The point that I’m trying to make in showing you all of this is that it’s important that we talk about special education. We have to talk about it in terms of complying with the law and regulations; we’ve got to talk about it in terms of doing the right thing for students, and helping them become successful and productive citizens — but the discussion is incomplete if we do not talk about how much it costs, and we just have to be eyes open about these types of analyses and how much this education actually costs.

I applaud the Board of Education for the hard work that they do in trying not only to understand those costs, but to manage them as efficiently as possible. It is not an easy job, by any means.

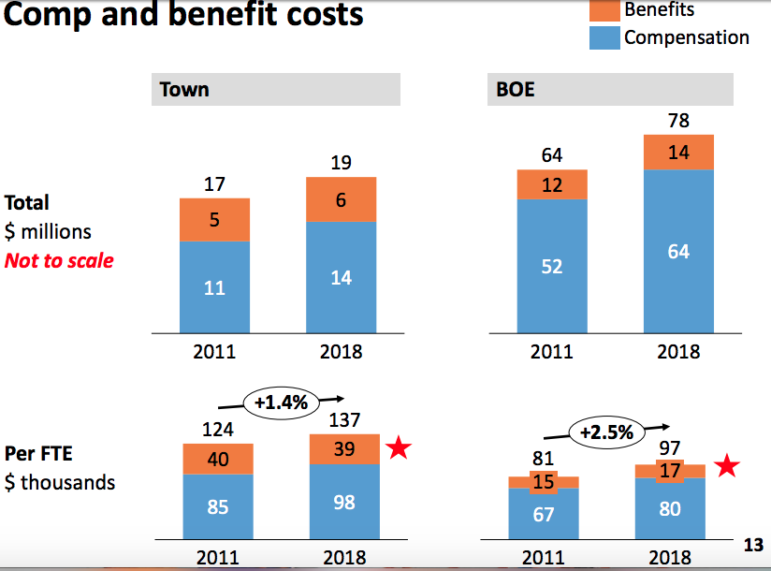

The last chart that I want to show before I conclude this section is that we looked at compensation and benefits both total, between the town and the Board of Education, and on a per-FTE basis — FTE stands for “full time equivalent” [of an] employee.

So what you see is that, down here at the bottom, on a per full time equivalent-basis, the town’s costs grew at about a 1.4 percent, per year, over that period of time. The Board of Education’s costs grew at about 2.5 percent, driven I think more by contractual arrangements.

But one thing that’s interesting to point out is that here, by these red stars, you’ll notice that the benefit costs for the town are much higher than they are for the Board of Education.

The reason for that? That’s because the state covers the pension costs for the teachers, as opposed to the town covering those costs. And so you get an idea, by looking at that, just how really expensive it is to make provisions to provide for the pensions for people who have those benefits in their contracts. Very, very expensive.

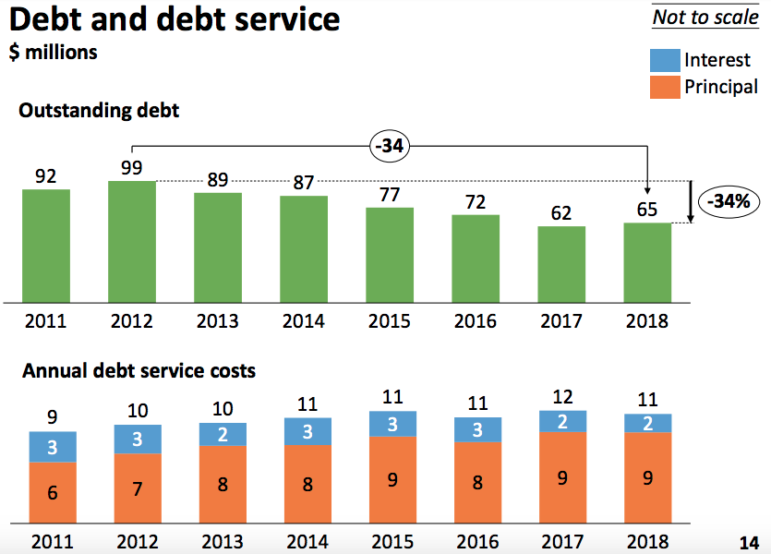

Finally, a couple of comments on our balance sheet. So, the first comment is to look at our outstanding debt. We talked about this for a long time, but this gives you an idea of just what we’re looking at.

From a peak of about $99 million in 2012, that’s following the high school [construction of a new building], following the completion of Tokeneke [the new elementary school building], where we had debt at fairly high levels, we’ve been aggressively paying down debt. We’re down this year to about $65 million.

That last little blip up here is the Highland Farms purchase as well as the public works garage [Town Garage]. You can see, we’ve progressively paid down debt, about $34 million or about 34 percent over that period of time.

The debt service costs — that part that’s in orange there, that’s the principal payments, that’s what we’re using to pay down this debt. You can see that those costs are relatively stable, in kind of in the $11-, $12-, $10.5-million-per-year range.

When we’ve done bonding at the Board of Finance, one of the things that we’ve tried to do is to make sure that we keep the payments level. In other words, we want principal and interest to be relatively stable over a period of time to sort of minimize taxpayer volatility, and this is a reflection of those intentions.

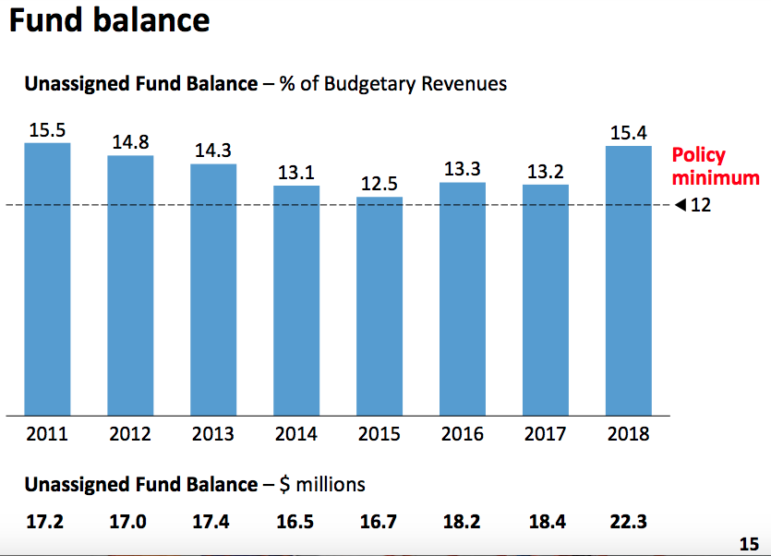

And the last part, then, on the balance sheet. So there’s this notion of the “fund balance” which I think you all are familiar with. These are basically the town’s reserves. This is a metric that a lot of people look at. And they look at it as a sign of financial health of the town.

The fund balance really is the town’s reserves that they can draw on in an emergency. We’ve never really had an emergency but these funds are there. One of the [groups of] folks that looks closely at this is the credit ratings agencies. They like to look at it as a percentage of your town’s revenues, and they would like to see a relatively healthy number. In fact this is one of the contributing factors to our Triple-A credit rating.

So right now, we’re sitting at about 15.4 percent of budgetary revenues. Recently the Board of Finance did a rewrite of the fund balance policy, and one of the things that we looked at was that metric.

We decided to adopt a metric that sets the percentage that the fund balance should be of annual budgetary revenues. The percentage that we adopted was 12 percent, and you can see that we’re above that floor, but not dramatically so.

So this is something that we need to watch, and to be clear, if it ever dipped below that, we would actually have to tax citizens to make sure that we keep that fund balance number healthy. […]

My conclusions on recent history: It’s a stable situation, I think, across the board. In terms of the grand list, let’s see what happens to the mix, and I welcome those [new] commercial properties, but historically it’s been relatively stable. Taxes, spending — again, all a nice, stable picture.

The balance sheet, I would argue is also in good shape. Our debt levels are much lower than they have been. I think we have significant debt capacity as a town, although we certainly don’t want to abuse that, and our fund balance is healthy in terms of the metrics that outside credit-rating agencies would look at to determine whether it’s adequate.

Obviously, special education costs are a concern, as I have said, but we live in an environment where children are aggressively diagnosed and treated with these types of problems, increasingly so. It’s an environment where caring and loving parents aggressively promote the interests of their children, and it’s an environment where law and regulations aggressively protect spending on this.

And so, in that environment, I think we have to do the best that we can for all parties concerned while making sure that we do our best to control costs. I applaud the efforts of the Board of Education and the administration to look carefully at all that, but again, this is something that we really just have to monitor and we just have to be aware of in terms of the cost burden on this town.

I guess my final conclusion here is that in my judgment the town and the schools have been well-managed from a financial standpoint.

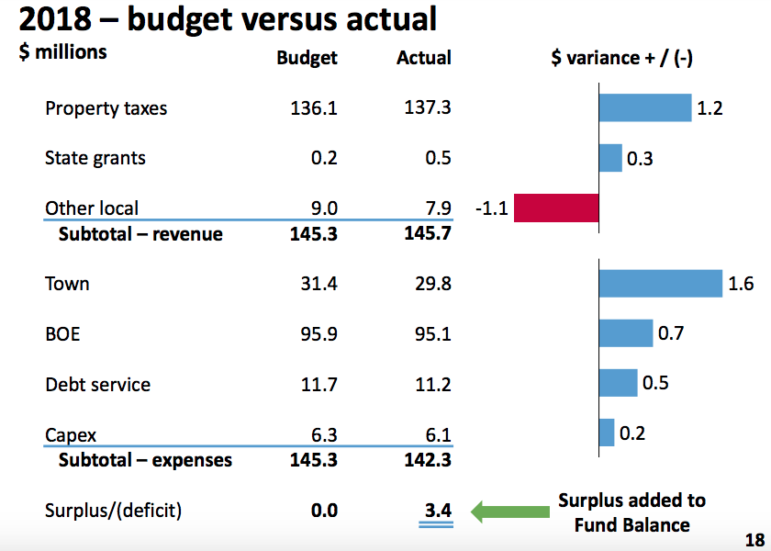

So today: Let’s look at just our current budget and our current finances. Hopefully this chart is readable:

What I did was, I took the current year’s budget and last year’s actual [spending]. […] What you see is, basically, revenue is pretty close. Property taxes collected a little bit more than budgeted, maybe other local revenue a bit less, but net net, very close to the $145.3 million that we budgeted.

The better news was that we ended up spending less. We ended up spending $1.6 million less for the town, and you can see the other totals there. But that’s where we ended up with the $3.4 million surplus.

A big part of that was the unexpected special education reimbursement that we got, which I think was a million dollars above what we had budgeted or forecasted with the Board of Education [budget], but you add that to the other, lower spending that we had, really, across the town, and you end up with a $3.4 million surplus, which we added to the fund balance.

That accounted for the spike in the fund balance that I showed you on that previous slide [see the page 15 slide, above].

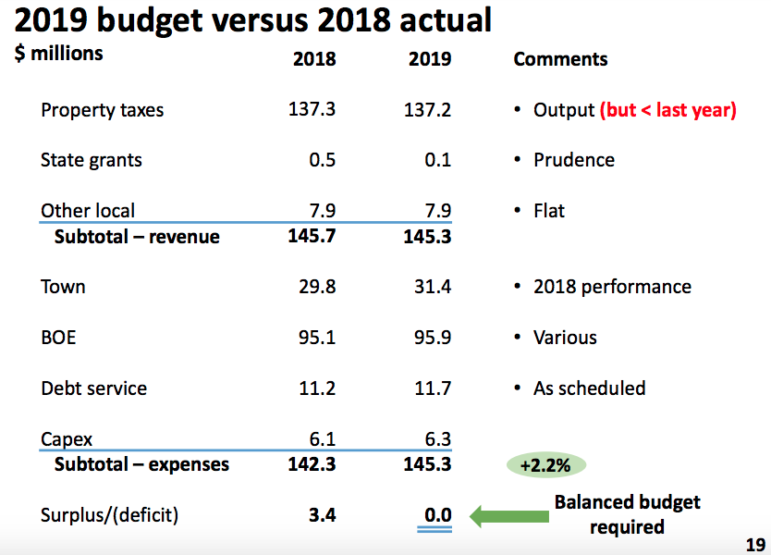

So, if you take a look at the budget for this year versus the actual for last year, here’s what you get. First, you see property taxes — and remember, property taxes are always just an output. In other words, we decide how much we’re going to spend as a town, and we add up all the other local revenue and whatever is left over, that’s what we have to raise with property taxes.

The number you’re seeing up here is flat versus last year, but it just happens to turn out that way. You’ll see, actually it’s very, very slightly less. And you’ll remember headlines from the paper when we passed the budget that property taxes actually dropped very slightly; the mill rate dropped very, very slightly, and that’s what you’re seeing right here.

So when it dropped slightly, it dropped slightly versus what we collected last year.

Last year, we actually got roughly $500,000 in state grants. We budgeted $100,000 this year. I think we budgeted education cost reimbursement at zero, and we got a couple hundred thousand, I think, for that this past year — but just out of prudence, we don’t budget much for state grants.

Other local revenues — flat. One of the things last year, we thought that the town was actually spending either flat to slightly less. This shows an increase, but remember, that $31.4 million is versus the low spending that the town actually came up with last year — this is versus actual [Fiscal Year 2018 spending] and not budget.

I won’t go through the rest of these other than to say that the total numbers in spending versus actual as opposed to budget this year we’re expecting to be about 2.2 percent over last year — not bad in the scheme of things, in my view.

So, “Current situation — observations”: In my view, modest growth. I don’t know of any major issues that are going to create significant problems this year. We seem to be on track to meet our current budget.

One thing I’d like to highlight is that there’s growing cooperation among all the boards with regard to the annual budget process. Lots of conversation, cross-participation and meetings, and I think some efficiency things that [First Selectman] Jayme [Stevenson] has suggested as part of the budget process that we’re trying to incorporate, and I think all of that continues to make a good difference.

There are a lot of people paying attention to all of this and I know that sometimes we get into controversies about how people are spending money, but I can assure you, having sat in too many of these meetings that there are a lot of good things going on in terms of smart, dedicated people who are important citizens of this town paying close attention to all this.

And so I would say, “Pretty good for the moment.”

So let’s take a look — this is my last topic — about tomorrow and this five-year forecast. So one of the things I am not doing today, as you’ve noticed with the paucity of paper around you, is the five-year forecast that I did before. I kind of decided that I don’t like that document, and so I just changed it — because I can. [LAUGHTER]

So you’re not going to get printouts of any of that. In fact, you’re not going to get printouts of this [presentation]. We’re going to post it on the website. So please download that. If you guys have any questions about any of that, I’m pretty sure you can track me down. But [it’s] just a change in approach this year that I’m hopeful will be helping you.

First of all, let’s come up with a baseline forecast. I think the way you want to start a baseline forecast is starting with historic growth rates. So I want to look at the town and the Board of Education, and I want to look at personnel and benefits costs, and I want to look at the grand list, and I want to look at non-personnel costs — and I want to just keep everything static and stable with no big changes. So, in other words, nothing new.

I’m going to use current debt, current debt service, no new capital spending, no new buildings, no schools, no changes in state funding. Nothing. It’s just a baseline.

So the five-year outlook for this, which hopefully is a helpful way to look at it — we’re going to look at spending and taxes. We’ll look at debt levels, but I’m going to resurrect that “taxes on the $1.5 million house.” The reason I think that’s important is because mill rates get hard to compare year over year when they get “contaminated” with the revaluations.

So, this model I give about a C+ in terms of sophistication. If I get more time over the course of this year, I’ll try to make it better and more integrated with debt and spending and all of that, but hopefully this gives you just a preview of what might be valuable in terms of thinking about the town’s future.

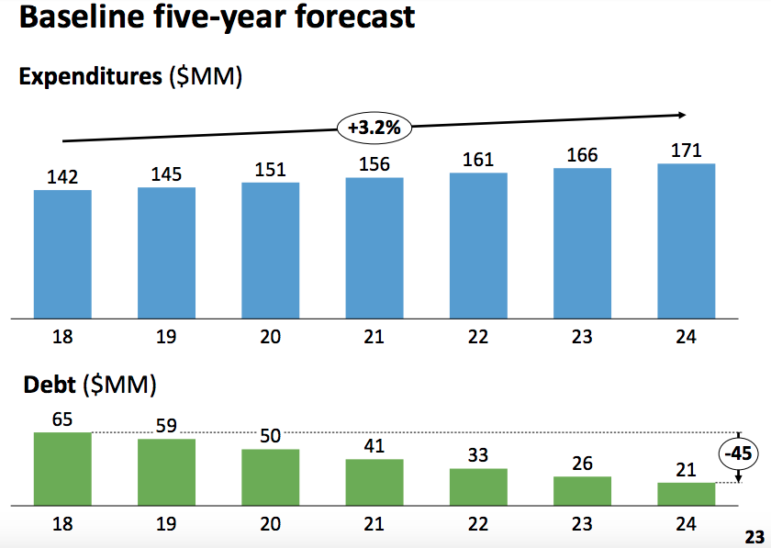

What does that baseline forecast look like? About a 3.2 percent increase [in compound annual growth in spending] forecasted from 2018 to 2024, and if we don’t build any new schools or new buildings or do anything fancy, that [debt] retirement schedule takes our debt from $65 million today, by 2024 (if we don’t do anything new and fancy) total debt will be down to about $21 million.

And another couple years after that, with $9 million in principal service, the town would actually be out of debt. We would have no debt.

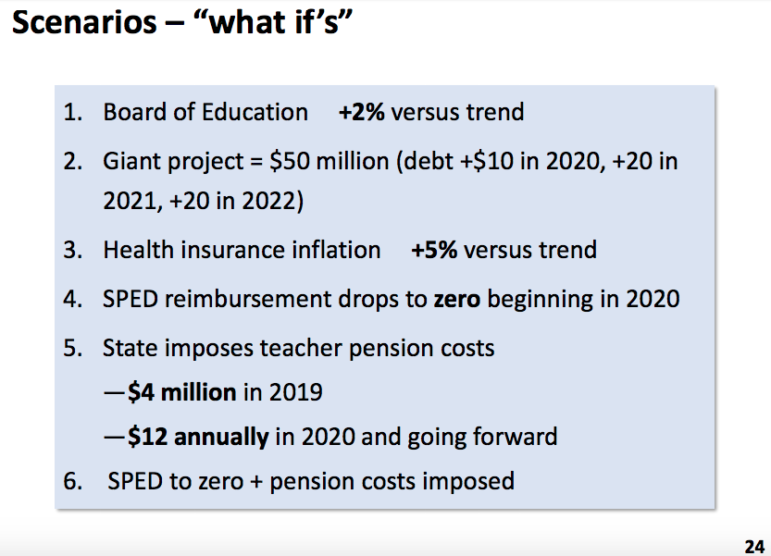

So what about some scenarios? Scenarios are just “what ifs.” What I tried to do is say, “What if the following things happened? How would that translate into an impact on our five-year forecast? So, late at night, walking around, I dreamed up some scenarios. I would invite you to challenge these — later of course, but let’s take a look at these.

So, what if you take the Board of Education [budget’s] recent spending trends and whatever that trend is, you add 2 percent to it, and you just compound that over five years, so the first scenario is, the Board of Education is 2 percent above trend.

How ’bout another one? What if we do a giant project? I don’t know what that giant project could be. It could be a shrine to Jack Davis [RTM member and chairman of the RTM Finance and Budget Committee] [LAUGHTER] and we could have a $50 million, you know, F&B Shrine — something like that. So let’s think of it that way.

But if we were to do that project, we’d clearly want to borrow for it, and so we’d put on $10 million in debt in 2020, and then $20 million in debt each year after that. So that could be our Giant Project Scenario.

[Editor’s note: Zagrodzky didn’t say so, but $50 million is in the general neighborhood of the cost estimates to rebuild Ox Ridge School.]

What about health insurance? Well that can be, well, you know, as much as 7, 8 percent a year. What if that was 5 percent over trend? [Editor’s note: In the “Baseline Five-Year Forecast” chart, page 23 above, 3.2 percent is Zagrodzky’s expected trend.] [It’s] certainly reasonable that could happen.

What if the state decides to take away all special education cost reimbursements, which we’ve had a lot of over the years?

What if the state imposed teacher pension costs. We know what that is. Some people in the state have thought that it may be a way for them to get out of or help resolve or mitigate their problem with state teacher pension costs — to start to impose those costs on the towns where those teachers used to work.

So we’ve done some math and about a third of that would be about $4 million a year, so what we’ve done in this scenario is to say they put a third of that in sometime in 2019, and then, going forward, in 2020, through the end of these five years, what if they made us pay the entire amount, $12 million a year, O.K.? That would be 100 percent of our teacher pension costs […]

And the worst case scenario: What if they took special education [grants] to zero and imposed all these costs? What would that be worth? Let’s take a look.

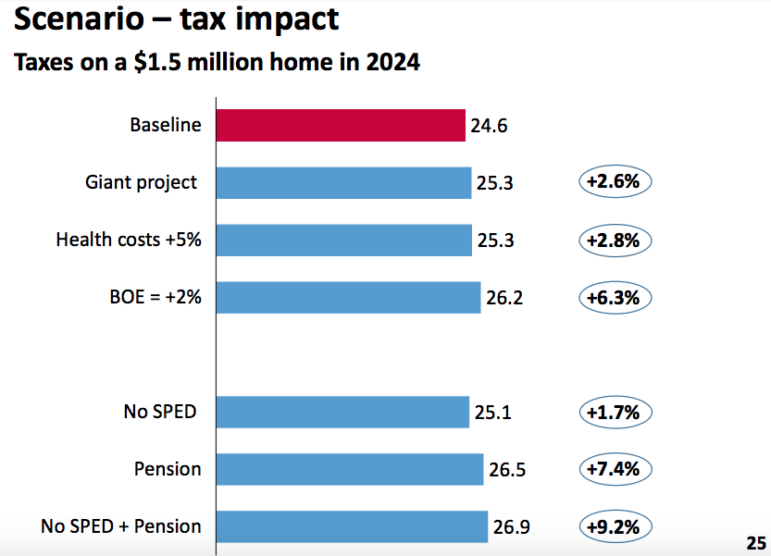

So what this slide shows is — I’ve tried to say, in 2024, let’s take our same friends that live in the $1.5 million house.

So the first thing we’re going to do is start with baseline. Assuming none of that stuff happened, we just have our regular baseline, those folks would be paying $21,600 in taxes on that house in 2024.

Let’s say the giant project goes through, we’ve got Jack, there’s a ribbon cutting, a lot of champagne, it’s fantastic. [LAUGHTER] The taxes that would be paid by that homeowner would be $25,300 — 2.6 percent higher. That’s with a $50 million project. Why is that? It’s debt financed, and financed over 20 years. And so the impact on the taxpayer, upfront, is going to be less, simply because, well, this is a long-term project, it’s financed over the long term.

But take a look at health costs: If health costs grow by 5 percent over trend, the taxes are almost 3 percent higher on that house — just for an increase in health costs.

What about the Board of Education? If the Board of Education ends up spending 2 percent more, it’s about 6.3 percent higher.

Now let’s take a look at what would happen if the state took some of those actions. If they took away special education reimbursement [grants], 1.7 percent higher. What’s interesting about that — look at the difference between special education, for which we’re getting maybe $3 million per year, versus health costs.

If health costs tick up maybe just 5 percent on the base that we have, the impact on taxes is higher than it is if the state takes away all special education reimbursement.

The big one though, is these pensions. That $12 million a year, if they put that on us, in terms of tax implications, are significant. Add both loss of the special education cost reimbursement and these higher pensions, taxes could be almost 10 percent higher [Editor’s note: 9.2 percent on the chart above] on the average homeowner in this town.

Now that, by the way, assumes really nothing else happens in town in terms of what we have to spend money on.

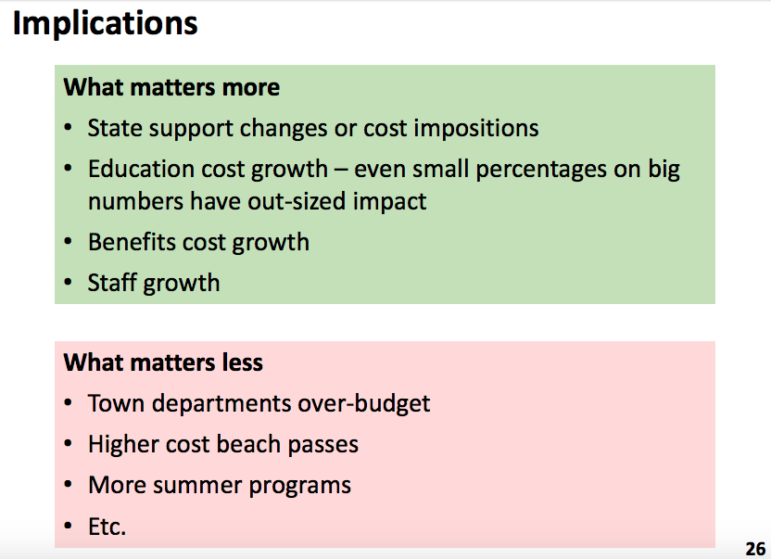

So the implications of this, in terms of how we think about our business on the Board of Finance and the way I would urge all of you to think about yours is this idea of what matters more and what matters less.

What matters more: State changes in support for the town or cost impositions by the state — they really matter. Education cost growth, even small percentages, can have big impacts on these numbers. That’s why I applaud their efforts to get the right balance between providing for our students while at the same time making sure there’s financial prudence in the provisions of those services.

Benefits cost growth and staff cost growth — both things that I’ve talked about in the past — they have a big long-term impact in terms of the financial health of this town.

There’s stuff that matters less, though: Town departments being over budget, higher-cost beach passes, more summer programs — I’m not being facetious here. Other than to point out, when I asked [Darien Finance Director] Jennifer [Charneski] to see if we could run a scenario that says, “What if Parks & Rec were 25 percent over budget for the next five years, what’s the impact on the house taxes? Nothing! It doesn’t matter.

I matters in an overall scheme if all the departments do that, but when there’s one department or one group that gets out of hand on the budget, any scenario planning that you do — it does. Not. Matter.

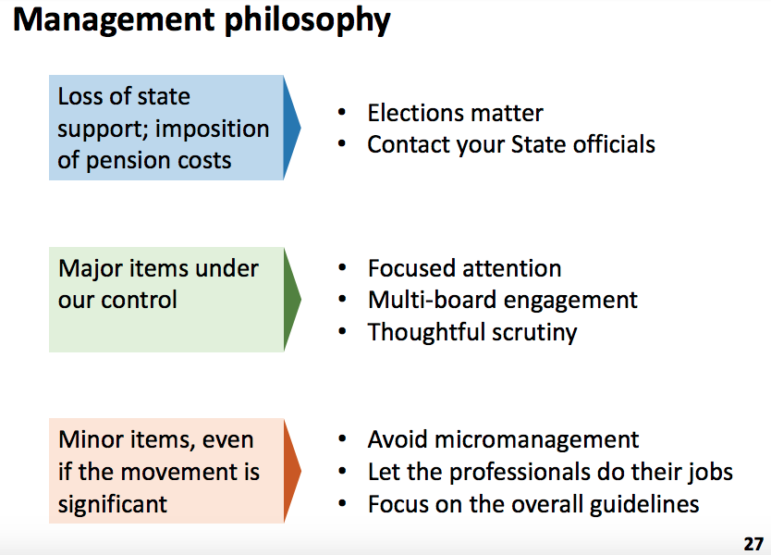

So in terms of management philosophy that would come from that? If you see in the future where we’ve lost state support, or we’re imposed pension costs by the state, it’s time to contact your state officials and to recognize that elections matter.

But if there are major items under our control, some of the things that I pointed out before — focused attention, multi-board engagement, thoughtful scrutiny — just like what we do today (there should be more of that).

But importantly, for the things that are minor, even if the movement is significant because it doesn’t change the long-term answer, we really should avoid micro-management. We should let the professionals do their jobs, and we should stick to focusing on the overall guidelines. If we say the guideline is X, we want to stick to that guideline rather than micromanaging that department that might be above guideline.

A final couple of slides here, and I’m done. I appreciate your patience.

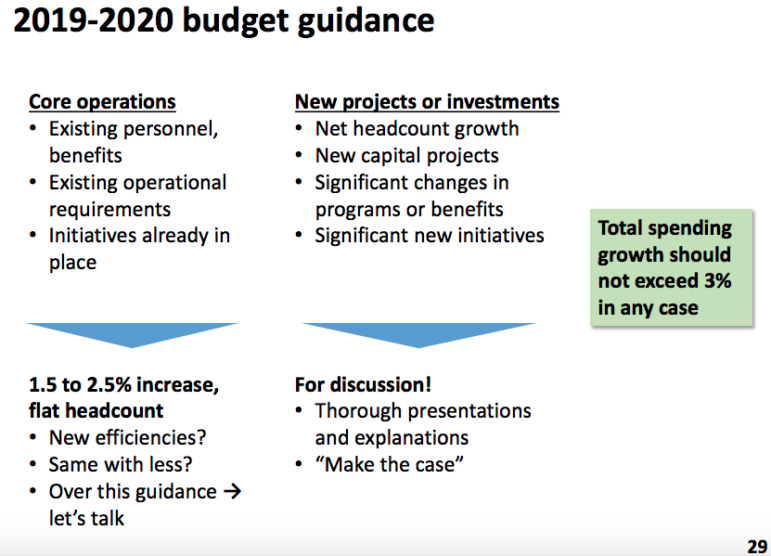

I did want to provide some guidance for the 2019-2020 budget process.

I want to split the guidance up a little bit, and look at this separately a bit.

The first piece that I’m going to point to is what I call “core operations.” This is existing personnel, existing operational requirements — stuff you’re already doing today. I think those things should be held to a 1.5 to 2.5 percent increase. That allows for contractual obligations, a little bit of an increase here and there, but importantly if we can keep to a flat headcount, I think some of that is possible.

Other things, though: So anything that is beyond what I would describe as core operations, what we’re doing today. I think that should be things like new net headcount growth, or significant new capital projects or big changes in benefits or in new initiatives. I think those things we ought to talk about.

This is where the RTM really can get involved. This is where the Board of Finance should have a lot of discussions about stuff that’s new, because every time we put something in there new it compounds over time, and it’s expensive.

In any case, I don’t think that the budgets should exceed 3 percent. We should try to keep it to that.

The last point that I’d like to make, and this is a request for the Board of Education, for my last slide:

A lot of the data that you saw today, particularly on the town side, was made possible through some software that the Board of Selectmen invested in a year and a half, two years ago, called “OpenGov.”

What OpenGov is, is when your town expenses, your town data — anything financial about your town — is put into that system, it enables a lot of reporting and analysis that you’re seeing today. I put them on my own slides, but that system provides a lot of this data.

Importantly for taxpayers, this data’s available online, and provides an easy way for everybody to get familiar with what spending we have, how it works and get a lot more informed about government.

So, the town has implemented OpenGov and I think it’s been fantastic. There are some analyses about the Board of Education that I was not able to show here because I don’t have the kind of transparency with that data that I do with the town data.

It does take some effort to implement OpenGov, but I would strongly urge the Board of Education and the administration to really consider this seriously.

If we can do that, we’re going to have better budgeting and reporting. We’re going to have access to benchmarks from other towns that we don’t have today, and importantly, we’ll have more transparent government spending for all the taxpayers and citizens […]

That is all I have to say. I hope it was helpful. Merry Christmas and Happy Holidays to everybody.

Editor’s note: Darienite.com added subheadings and made minor changes to reflect this publication’s editorial style. Also, since the talk was given in a conversational style without a written speech, we removed some verbal tics and repetitions that we tend to ignore when listening but become distracting when reading the same words.

Watch Zagrodzky’s Speech on This DarienTV79 Video

Zagrodzky speaks from about 25:30 to about 58:30 (including Seth Morton’s comments at the end):

Pingback: Editorial: Don't Criticize Public Officials for Merely Noting How Much Special Education Costs - DarieniteDarienite