You can make it less likely that you’ll become the victim of a skimming device placed on an ATM by a thief by following these steps, according to the FBI.

Here’s the FBI’s list of tips:

- Inspect the ATM, gas pump, or credit card reader before using it — be suspicious if you see anything loose, crooked, or damaged, or if you notice scratches or adhesive/tape residue.

- When entering your PIN, block the keypad with your other hand to prevent possible hidden cameras from recording your number.

- If possible, use an ATM at an inside location (less access for criminals to install skimmers).

- Be careful of ATMs in tourist areas — they are a popular target of skimmers.

- If your card isn’t returned after the transaction or after hitting “cancel,” immediately contact the financial institution that issued the card. [Editor’s note: Having each of your card’s phone numbers and card numbers handy in your wallet would make that easier.]

An additional point: “ATMs aren’t the only target of skimmers—we’ve also seen it at gas pumps and other point-of-sale locations where customers swipe their cards and enter their PIN.” [Editor’s note: The Connecticut Department of Consumer Protection has some advice about protecting your card information when buying gas.]

_______________

Like this article? …

- Sign up for the Darienite.com weekday newsletter.

- Like Darienite.com on Facebook.

- Follow Darienite.com on Twitter.

_______________

From Darienite.com:

What Skimmers Are and How They Work

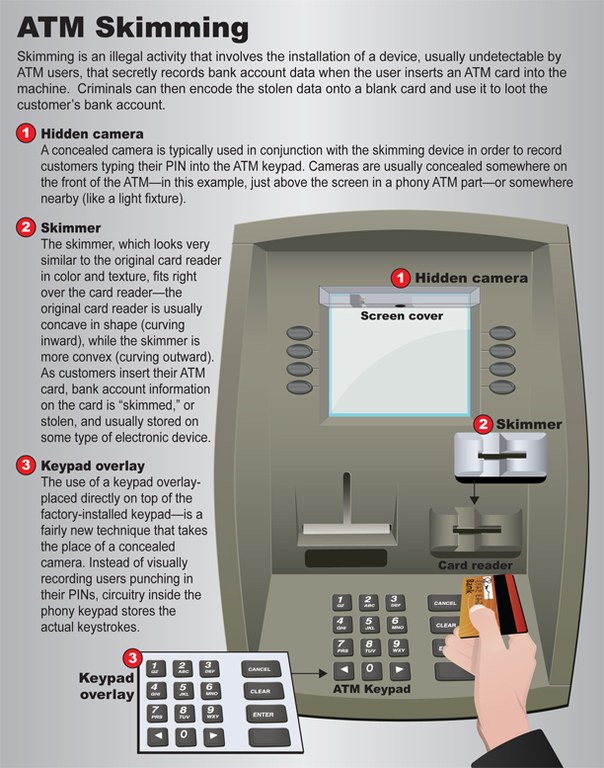

Skimmers typically are carefully constructed covers that are meant to fool ATM users into thinking that they’re inserting their cards into the ATM. (Some skimming devices have been found that slip inside the card slot.)

Instead, when a customer inserts a credit or debit card and provides PIN codes or passwords, the skimmer records the information on the magnetic strip of the card. The skimmer may use a hidden camera to get the PIN code. The skimmer passes on the information to the ATM, or allows the card to pass it on, but then uses the information to remove money from the account connected with the card.

Skimming devices, to be effective, are created with extreme care, and it can be difficult for ATM users to spot them.

See also:

- How to Spot and Avoid Credit Card Skimmers (PC Magazine, April 5, 2016)

- Four Tips to Protect You from ATM Thieves (Bankrate.com)

- How to Spot ATM and Pin Skimming Devices (Ossian Bank)

- All About Skimmers (Krebs on Security blog, 2010 to 2016 — more than you probably want to know, and much of it depressing)

Pingback: Skimmer Found on Darien Bank ATM - DarieniteDarienite

Pingback: Darien Resident's Credit Card Info Stolen, Money from Account Drained in NYC, California - DarieniteDarienite