Good evening. My name is Jon Zagrodzky, and I’m chairman of the Board of Finance. Once again, I’m glad to be here tonight and have a chance to offer some thoughts, on town finances and maybe a few other things.

__________

Editor’s note: This is Board of Finance Chairman Jon Zagrodzky’s State of the Town speech, delivered (along with speeches from three other town officials) Monday night to the Representative Town Meeting. We think the full speech provides readers with an insight into town issues. This is the text of the speech as sent to Darienite.com on Tuesday morning. Speech texts often differ in very minor ways from the spoken remarks, which will be rebroadcast by Darien TV79 on cable television and, later, on Vimeo.

__________

Photo from Darien TV79

Jon Zagrodzky, chairman of the Board of Finance, at last year’s State of the Town address. (He hasn’t aged a bit.)

I’d like to start by referencing the materials that you have in front of you today. [Some images of the document are published on this Web page, particularly at the bottom, but the easiest way to read it is to see this PDF document on the town government website.]

As we have done for a long time, these pages represent our five-year financial forecast for the Town.

The output you see is result of some assumptions we made about various elements in the budget.

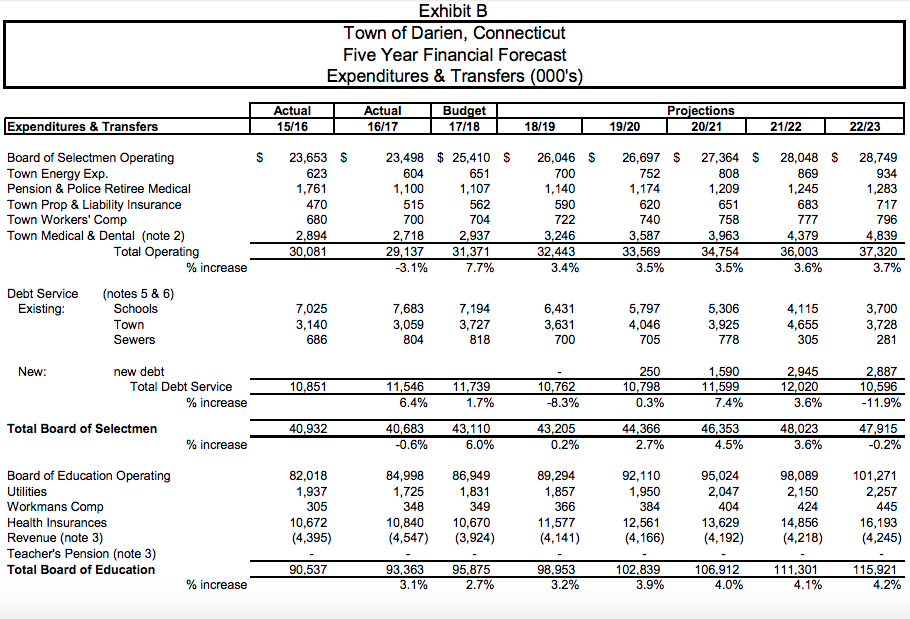

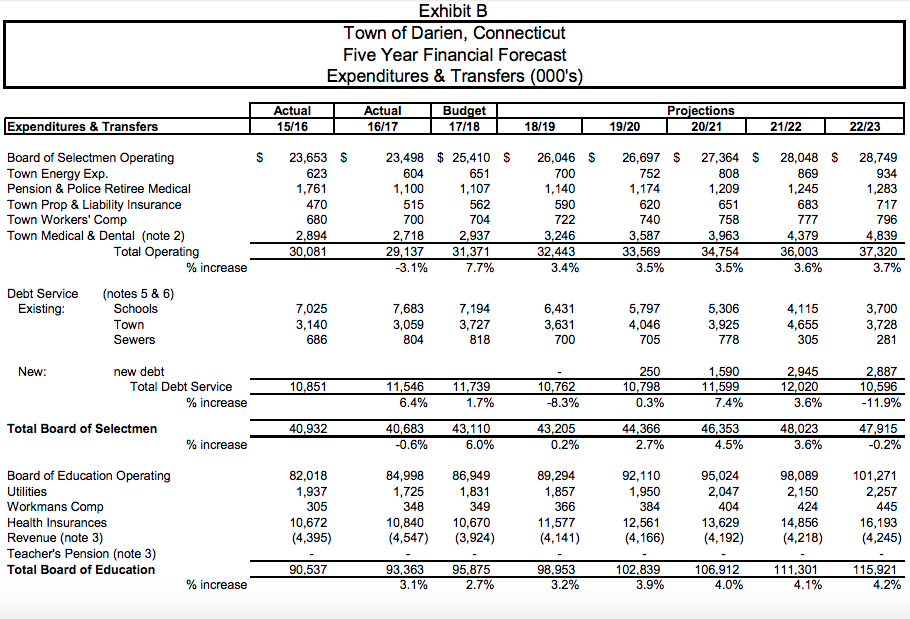

Exhibit B is the first slide. For those of you watching on TV, these materials are available on the Town website.

Table from the 2017 five-year financial forecast

Exhibit B

In terms of headlines, expenditures in the current fiscal year total about $145 million, of which $31 million is the Town [spending supervised by the Board of Selectmen], about 22 percent, $96 million is the Board of Education [spending supervised by that board], about 66 percent, $11 million is debt service, about 8 percent and $6 million is capital spending for which we don’t borrow, about 4 percent.

Interestingly, we were able to pull up records from 1990 and look at these same percentages: back then, Town spending as a percentage of the total was higher — 32 percent, while education was lower at 60 percent. And that’s reflective of the fact that education spending has grown more quickly over time.

Exhibit B shows the current year budget versus the actual numbers from the prior year. The first number I’ll point out is the total operating budget, which is the Board of Selectmen budget excluding debt service. It shows a $2.2 million jump, or 7.7 percent.

This may seem alarming, and a much higher percentage than we talked about at budget time last spring. The reason for the big number is that the Board of Selectmen actuals for last year came in lower than what we forecast: a surplus in contingency, a renegotiated waste hauling contract, and some police vacancies and retirements — all in all, this meant lower than expected costs. If you compare our budget to the forecast at the time, the projected increase was just 2.2 percent.

Anyway, I promise that we didn’t mean to raise spending by the percentage shown! It’s just a math problem. The other numbers you’ll notice are the lower debt service figures for the next two years. We actually planned this in case we faced some costs from the State, so this gives us a little breathing room for these two years.

The rest of the columns on this page are the five-year forecast. This forecast reflects some things we know, like service on existing debt, some things we think we can reasonably predict, like maintenance costs, and some things about which we have no clue, like state reimbursement for excess special education costs. I’m not going to go through Exhibits C, D and E, but I hope the takeaway from all this is that our financial situation is relatively stable, as it has been since at least 1990.

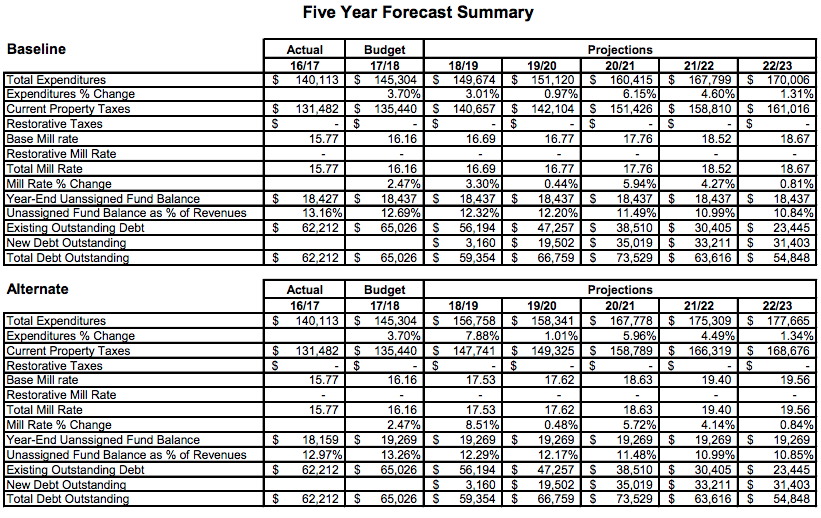

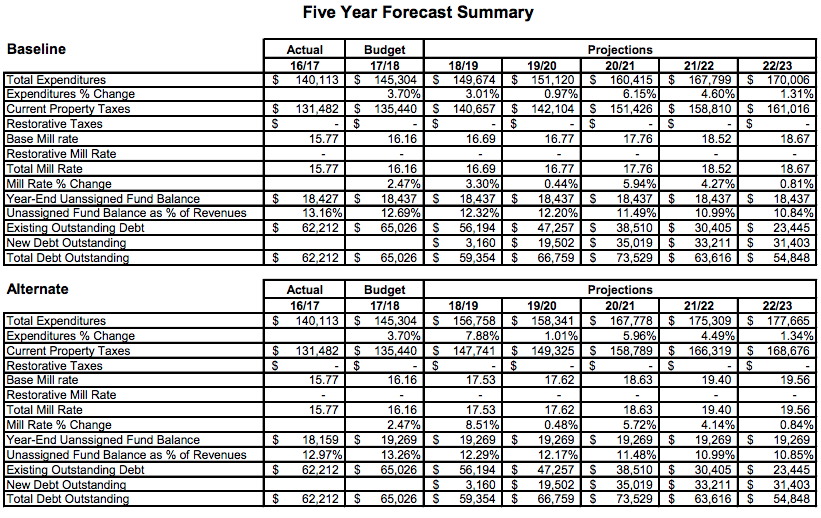

I would like to spend a minute on the last page, though, which is new. This page is a scenario page. What you’re seeing on top is the baseline forecast, which draws its numbers from the earlier exhibits. The bottom half of the page, however, shows an alternate view with two key changes.

From the Darien 2017 Five Year Financial Forecast

Last page of the 2017 five-year financial forecast for Darien

The first assumes that the state’s reimbursement for excess special education costs, about $2.5 million for next year, is reduced to zero.

The second is that the state begins requiring us to contribute to teacher pensions, and the number they talked about was $4.5 million. The bottom line is that instead of a roughly 3 percent estimated mill rate increase for next year, we’d have a nearly 8 percent increase. And that’s assuming they don’t impose more teacher pension costs – remember, the $4.5 million is only one-third of the annual contribution they’re supposed to make on our behalf.

You will recall that we talked about all this last year. We even thought about assuming no special education reimbursement in this year’s budget. But the budget the state finally approved lacked the costly changes that we worried about. As a result, I am not having to stand here and talk about interim tax increases or mid-year budget cuts, which is great.

However, this is not the time to relax. The State’s financial problems did not go away. Yes, there were clear improvements passed as part of the budget, like requiring legislative approval for union contracts, but the central problems of inadequate funding for generous benefits combined with ongoing revenue shortfalls have yet to be solved.

In a way, I am not surprised. In my presentation to you last year, I talked about “sustained unsustainability” and how the state seems to keep going along despite financial problems of cartoon-like proportions. I also said that “I suspect I’ll report next year that all this unsustainability has been sustained for yet another year.” I am happy to say that at least in this one case, my prediction has come true. And I am modestly confident in affirming this same prediction for next year.

Another point I made, however, is that all this will continue, until it can’t, and when it can’t, all bets are off. In the meantime, we owe it to taxpayers to maintain tight local discipline on all spending while this gets sorted out. And don’t forget, local taxes are about to get more expensive given the elimination of state and local tax deductibility in the recently-passed federal tax reform legislation in Washington.

What does this mean in terms of guidance for budgets this year? Without stealing her thunder, Jayme is asking Town departments to target a zero percent increase, which we should applaud. I don’t think Dr. Brenner is going quite that low, but I know he is focused on it.

I think aggressively low percentage targets are fine, and I look forward to seeing what both Boards suggest in their draft budgets. I also recognize that we have union contracts, facilities to maintain, and lots of other costs that aren’t static — I get it. That said, my further guidance for your consideration would be as follows:

First, now is not the time to start programs or initiatives. It’s not to say that the answer should be no in all cases, but we should scrutinize any plans to start something new, whatever it is.

Second, all the professionals who lead the schools and Town departments are striving for efficiency, but I would invite both Boards to challenge these professionals to go further. What’s the most radical thing they can propose to deliver services more efficiently? Even crazy ideas should be on the table. Maybe there should be a prize.

My last bit of budget guidance pertains to headcount. As I pointed out in my address to you two years ago, the long-term cost of hiring someone is shockingly high. You’ll recall that just two union employees with salaries in the mid-$50s and employed over 20 years cost as much as the $7 million Shuffle project financed over the same period.

So, we will ask both Boards to analyze their head counts and be prepared to defend any net increases for next year. I would like to see headcount budgets as well as dollar budgets. And don’t replace headcount with consultants — I’m watching for that, too.

Let’s talk now a little about town debt and capital spending. There’s great news, good news and no news. First, the great news.

Moody’s conducted a ratings review in August, and they had a lot of questions, particularly around the potential impact of state financial dysfunction on Darien’s finances. Despite the state problems, Moody’s sees that Darien is a well-managed town with adequate resources. As a result, they affirmed Darien’s Aaa rating and stable outlook.

This means that we’ll continue to have the best terms when borrowing, something many other towns no longer have. We have some work to do to maintain this rating, like ensuring that our Fund Balance reserves remain adequate, but we are in good shape.

Next, the good news. We started this fiscal year with about $62 million in debt, the sum of both town and school projects. This is down from a high of just under $100 million in 2012, when the high school debt was bigger, and we had just finished Tokeneke.

This year, we’ve added a little over $12 million in debt for the Ox Ridge land acquisition and the public works garage, but with scheduled principal pay down, we’ll be at about $65 million next June. Assuming no major school projects, we’d be down below $50 million in about three years — pretty good.

And now, for no news. Senator McLaughlin and I were talking the other day, and we both remarked at how long it seems that we have all been talking about plans for major school capital projects — at least five years.

I know there have been studies, meetings and discussions, but after all this time, we still do not have a complete proposal to consider. In other words, no news. I think we would all benefit from coming to an agreement as to where we need to make major investments in our schools.

Low interest rates won’t last forever, and our debt load is approaching a point where we are in a position to make needed — and smart — investments. When we get to this point, there’s a lot we can do to ensure good communication and financial planning, so I look forward to talking about this.

As an aside, I’m personally not supportive of considering other major capital projects, like those envisioned in the very expensive-sounding Parks Master Plan, until we have potential school investments sorted out.

Finally, the best for last. The best thing about Darien is the people, and I’d like to mention a few. First, my gratitude goes to two outstanding members who have left our Board, Bruce Orr and Dave Lopiano.

Bruce has been part of Darien’s government since it was invented, and I suspect he’ll be involved in something else soon. Dave is life-long resident of this area and a great family friend. Both contributed in valuable ways to our deliberations and will be missed.

At the same time, a warm welcome is due for Rob Cardone and Paul Hendrickson. Rob more recently served in this august body as a member of F&B [the Representative Town Meeting Finance and Budget Committee], so he brings great experience to the table. Paul served previously as a Selectman and Board of Finance member, and most recently as the Director of Finance for the Ridgefield public schools.

Darien works because talented people like these gentlemen, and like all the terrific individuals in this room, step up to make a difference — and for that, I am truly grateful.

That’s all I have to say. Thank you for indulging me. Happy Holidays.

SIDEBAR:

Darien Five-Year Financial Forecast Through 2023

Zagrodzky referred to this document in his speech. We reprint parts of it here, but, as noted above, you can find the whole thing in easier-to-read format here on the town government website.

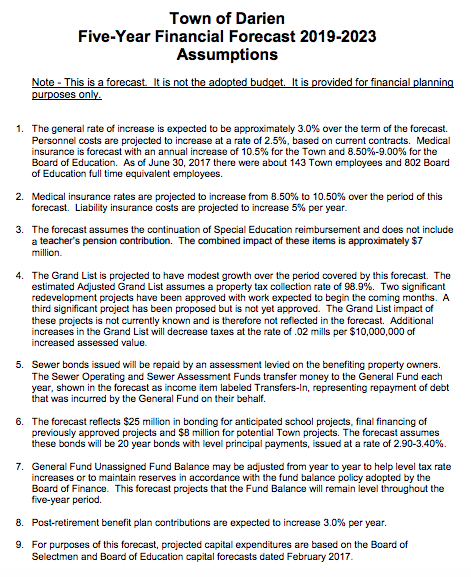

Excerpt: Assumptions:

Note – This is a forecast. It is not the adopted budget. It is provided for financial planning purposes only.

1. The general rate of increase is expected to be approximately 3.0% over the term of the forecast. Personnel costs are projected to increase at a rate of 2.5%, based on current contracts. Medical insurance is forecast with an annual increase of 10.5% for the Town and 8.50%-9.00% for the Board of Education. As of June 30, 2017 there were about 143 Town employees and 802 Board of Education full time equivalent employees.

2. Medical insurance rates are projected to increase from 8.50% to 10.50% over the period of this forecast. Liability insurance costs are projected to increase 5% per year.

3. The forecast assumes the continuation of Special Education reimbursement and does not include a teacher’s pension contribution. The combined impact of these items is approximately $7 million.

4. The Grand List is projected to have modest growth over the period covered by this forecast. The estimated Adjusted Grand List assumes a property tax collection rate of 98.9%. Two significant redevelopment projects have been approved with work expected to begin the coming months. A third significant project has been proposed but is not yet approved. The Grand List impact of these projects is not currently known and is therefore not reflected in the forecast. Additional increases in the Grand List will decrease taxes at the rate of .02 mills per $10,000,000 of increased assessed value.

5. Sewer bonds issued will be repaid by an assessment levied on the benefiting property owners. The Sewer Operating and Sewer Assessment Funds transfer money to the General Fund each year, shown in the forecast as income item labeled Transfers-In, representing repayment of debt that was incurred by the General Fund on their behalf.

6. The forecast reflects $25 million in bonding for anticipated school projects, final financing of previously approved projects and $8 million for potential Town projects. The forecast assumes these bonds will be 20 year bonds with level principal payments, issued at a rate of 2.90-3.40%.

7. General Fund Unassigned Fund Balance may be adjusted from year to year to help level tax rate increases or to maintain reserves in accordance with the fund balance policy adopted by the Board of Finance. This forecast projects that the Fund Balance will remain level throughout the five-year period.

8. Post-retirement benefit plan contributions are expected to increase 3.0% per year.

9. For purposes of this forecast, projected capital expenditures are based on the Board of Selectmen and Board of Education capital forecasts dated February 2017.

Document from the town government website

Town of Darien Five-Year Financial Forecast 2019-2023 Assumptions

Table from the 2017 five-year financial forecast

Exhibit B

From the Darien 2017 Five Year Financial Forecast

Last page of the 2017 five-year financial forecast for Darien