If you needed yet another nudge to start keeping an eye on your credit report to protect against identity theft, Capital One has delivered it with its announcement that a data breach has exposed the personal information of 106 million of its credit card customers and credit card applicants in the U.St. and Canada.

— Sheena Gressin is an attorney in the Federal Trade Commission’s Division of Consumer and Business Education. This article is from the FTC Consumer Information blog.

News of the Capital One breach comes just one week after the Federal Trade Commission announced that Equifax agreed to pay up to $700 million to settle a lawsuit brought by the FTC, the Consumer Financial Protection Bureau, and 50 states and territories, stemming from the credit reporting giant’s 2017 data breach, which affected about 147 million people.

In the Capital One breach, 100 million people in the United States and 6 million in Canada were affected. According to the bank, most of the stolen information came from the credit card applications of consumers and small businesses. The information includes names, dates of birth, addresses, phone numbers, and more, all from applications filed between 2005 and early 2019.

For credit card holders, the stolen information includes credit scores, credit limits, balances, payment history, contact information and some transaction data.

_______________________

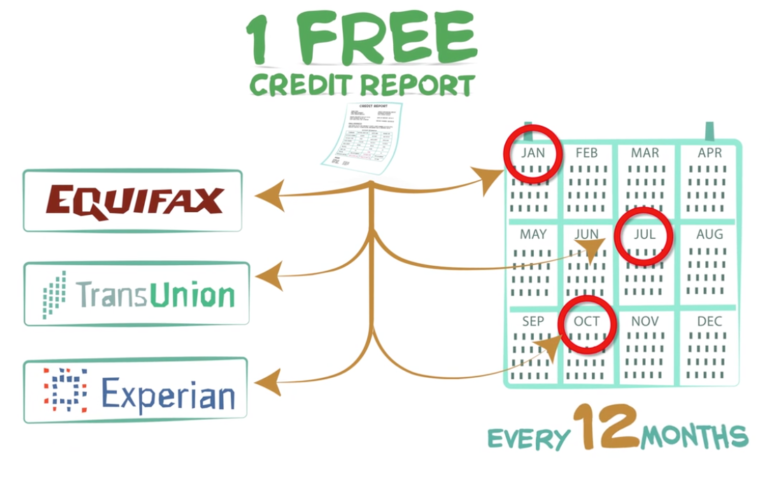

For a larger version of this 1-minute-49-second video, click on the lower righthand corner icon to allow full screen.

_______________________

The bank says the hacker also stole about 140,000 Social Security numbers, 80,000 linked bank account numbers of secured credit card holders, as well as the Social Insurance Numbers of about one million Canadians.

Capital One has posted information about the breach and says it will notify the people affected and offer them free credit monitoring and identity protection services. However, whether or not you were affected, there is no time like the present to check your free credit report and take other steps to protect against identity theft.

Image from the FTC video

Check out these articles to read the basics about credit reports and credit monitoring. And one more thing: a data breach is a magnet for scammers.

Be alert to emails and calls pretending to be from Capital One or the government. Neither the bank nor the government will send an email or call you to ask for credit card or account information or your Social Security number.

Visit Identitytheft.gov/databreach to learn more about protecting yourself after a data breach.

SIDEBAR:

More Effective Than Credit Report Checking

Michelle Singletary, a personal finance columnist for the Washington Post, wrote on Tuesday:

- “There is one step that is notably strong in protecting you against fraud. […]

- A law enacted last year gives consumers the right to a free credit freeze, also known as a security freeze, at all three major credit bureaus — Equifax, Experian and TransUnion. You can learn how to place a freeze at these bureaus on the Federal Trade Commission’s website […]”