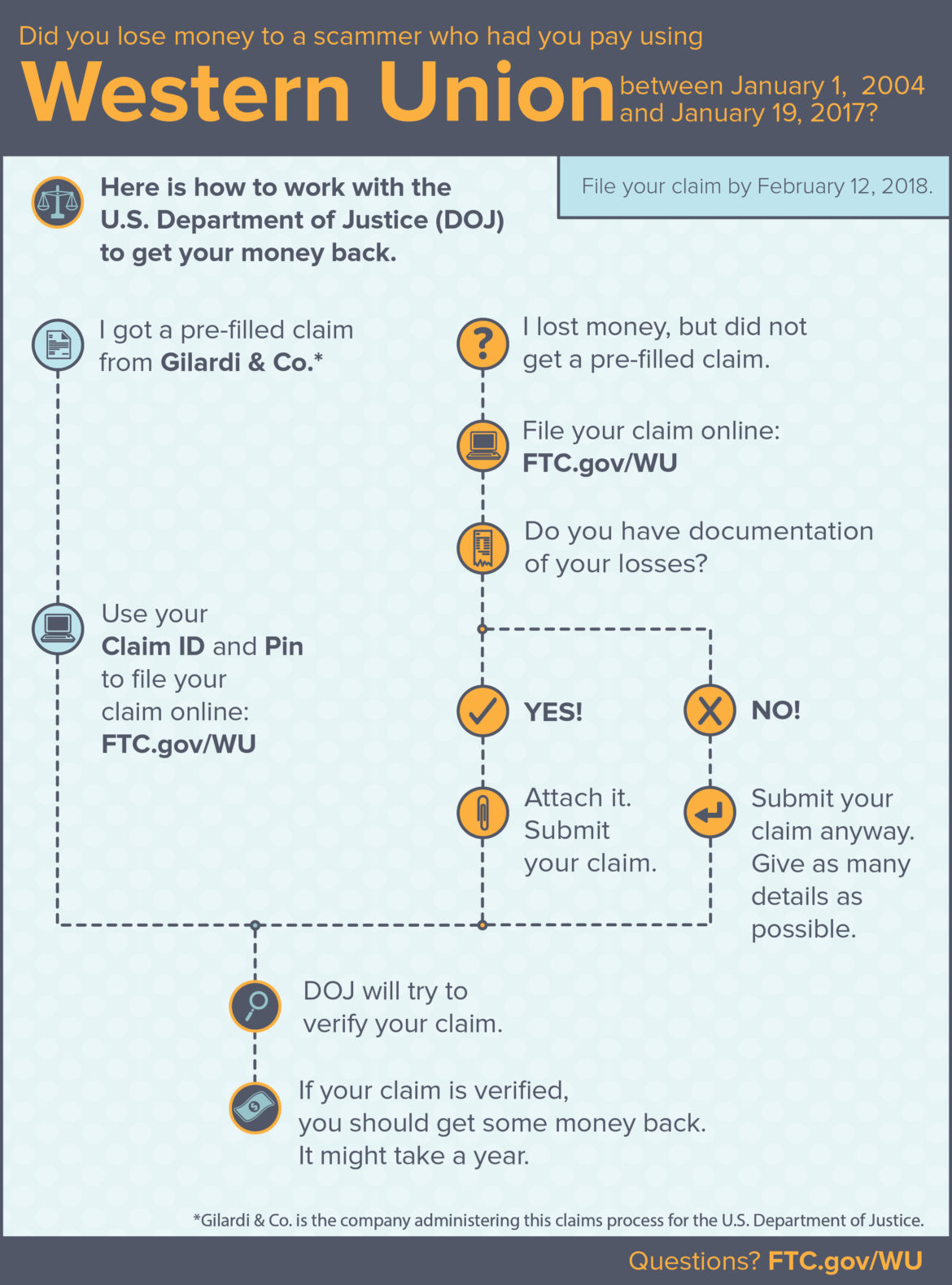

Did you lose money to a scammer who had you pay using Western Union between Jan. 1, 2004 and Jan. 19, 2017? If so, you can ask for money back from the FTC’s settlement with Western Union. And the deadline to file your claim was just extended to May 31, 2018.

Here’s the deal. Western Union agreed to return $586 million to people to settle the FTC’s charges that Western Union hadn’t adequately protected people from fraud, and didn’t properly discipline problem agents. To get money back, here’s what you need to do by May 31, 2018:

- Start at FTC.gov/WU to file your claim online. If you got a letter in the mail about a complaint you filed earlier, you’ll have a Claim ID and a PIN. Click the blue “I got a pre-filled claim form” button and use those to file your claim. If you didn’t get a letter in the mail, click the orange button that says “I lost money, but did not get a claim form.”

- Give as much information as you can about your loss. Upload any paperwork you have. The Department of Justice, which is handling the claims through their contractor, Gilardi & Co, will use that information to try to validate your Western Union money transfer.

- Yes, you have to give your Social Security number or ITIN to file a claim. Read why here.

- Don’t pay anybody to help you file your claim, or get money back. Anybody who asks you to pay for your claim or refund is scamming you. Tell the FTC.

- Then, be patient. It might take a year for the Department of Justice to validate all the claims and start returning money.

If you have questions, you might find answers here, and also check out the FAQs at FTC.gov/WU. Why not do it now? But you have until May 31, 2018. After that, you won’t be able to file your claim to get money back under this settlement with Western Union.

__________

— This article was originally published in the Federal Trade Commission Consumer Information blog on Feb. 1.